“This too shall pass” – medieval Persian poetical saying.

The Big Money (Sovereign Wealth Funds, Global Pension money etc.) invests primarily on the basis of Currency – they first select the currency they wish to invest in and THEN the asset class that they prefer, according to their risk tolerance… It is the ebb and flow of this gigantic amount of money that creates Capital Account surpluses and deficits, which in turn can move interest rates and thus currency values themselves, in a feedback loop. Global Capital moves to where they feel safest, and at times they all seem to agree on a preferred course of action – this may be one of those times.

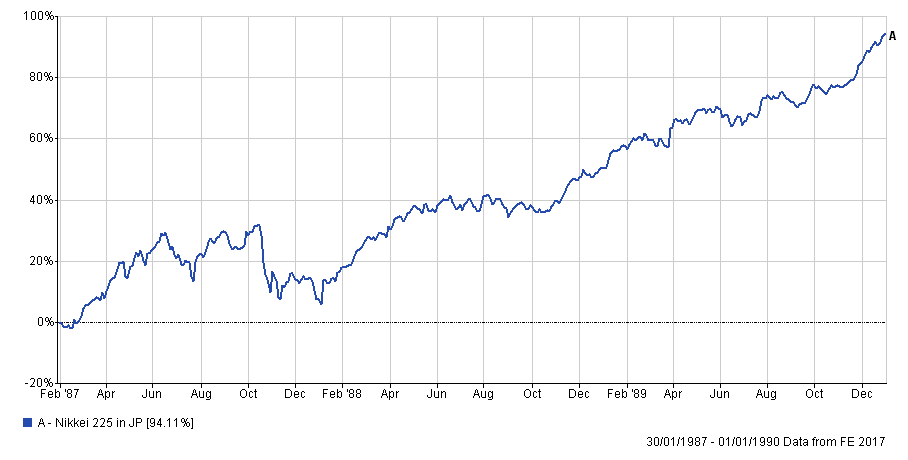

This can lead to what is referred to as Capital Concentration, whereby Global money all coalesces into one region, asset class or even sector at the same time. The Internet bubble was an example of the latter[1], but back in the 1980’s we saw a huge move into Japanese assets, particularly Real Estate, where at one point the Emperors Palace was said to be worth more than the whole of California; this seems absurd, but was widely believed at the time. Japanese equities too had a strong run. As the chart below shows, the market Index almost doubled over less than 3 years. What is interesting about it is that the returns were equally strong across ALL major currencies. This would not normally be expected. All things being equal, a weaker currency tends to boost the local share market (for an extreme example see this Zimbabwean Index chart) as a weaker currency boosts exports and helps to reduce trade deficits, whilst at the same time preserving the purchasing power of money [2]. As a result, the Euro and Sterling returns for the Nikkei during this period were +93.7% and +94.7% respectively. (The US Dollar return was even better, at +107.3%). So the local return was very similar to that of foreign investors, something that conventional theory suggests should not happen. Nevertheless, a market/asset that moves at similar rates of appreciation in multiple currencies is often a sign of capital concentration occurring.

So why did it do so? Because the flow of money from ALL sources (domestic and foreign) overwhelmed the negative effects of a stronger Yen on market sentiment – investors were buying because they believed in the Japanese “story”. This article is from 2008, but it hints at the expectation of long-term Japanese economic growth, and the expectation that it would continue, culminating in them becoming the next economic superpower. Sounds ludicrous now but people genuinely believed in it.

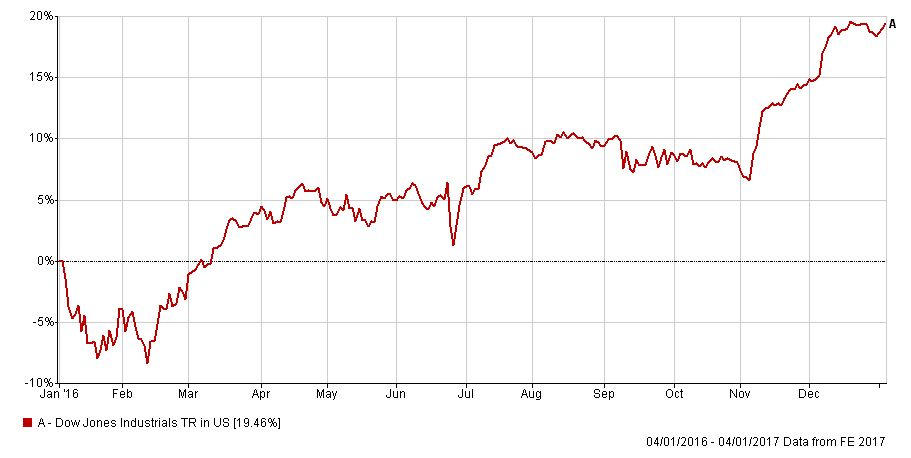

Fast forward to today and the election of Trump has led to a near euphoria about re-construction, reflation and the like. In a world bereft of genuine alternatives (where else would an institution feel “safe” investing now, especially in a more politically charged world?), the Euro looks like it might even fail, Sterling is now out on its own, the Yen is being actively destroyed by the Japanese themselves and no other currency provides anything like the liquidity that the Dollar does [3]. How about the Rouble anyone? Anyone?

Institutions are responding to risks and opportunities by going for perceived “safety”. When a sufficient number do so, it creates the sort of positive feedback loop whereby the Dollar rises (as in the current iteration); they cannot park their money in cash (as Interest rates are so low), so they buy either bonds or equities. So far, it appears they have gone for equities. As the 1-year chart below highlights, the situation seems to be playing out in similar fashion to that of 1980’s Japan, (though on a shorter timescale for now). Interestingly, the returns expressed in other currencies are similar in scale, with the Dow in Euros +23%, in Yen +17.5% and Sterling +42% (due to the sharp fall in wake of the Brexit vote). It is far too early to be certain, but the comparisons are intriguing.

What does this all mean for Investors? It may mean that we are about to witness another bubble, but that is conjecture for the moment. However, one of the major characteristics of a bubble is widespread retail (or individual) participation – remember the Day Trading fad of the early 2000’s? This is almost entirely absent, which could either require prices to rise MUCH higher to entice them in, or if not, could lead to a natural reduction in demand and thus price falls.

Either way, the same principles apply; we cannot know with any precision when (or if) a bubble has begun, so diversification and disciplined rebalancing are the best tools at our disposal. Both prevent investors getting sucked into manias, from which it will be almost impossible to exit. (In my days at an ‘execution-only’ stockbrokers in Leeds around 2000, I vividly remember one investor telling me that he wasn’t going to sell, to avoid paying CGT on his gains; 6 months later that was no longer an issue). It is psychologically exceedingly difficult to sell both during and after a bubble (fear of missing out on gains is quickly replaced by just fear) and so spreading investments widely avoids that mind trap. It also helps to avoid the risk of being caught by the sudden downside volatility that often emerges just prior to, and post the ultimate market peak. Rebalancing also achieves the same end – as risk exposure to one asset class (US equities for example) rises, one uses the price appreciation to take profits and reinvest in other assets, ensuring that if/when the peak arrives, one is not too overweight in any given market/asset/sector etc.

Following these practices in no way avoids the consequences of a potential bubble, but it does make it easier to avoid the obvious errors of panic/over-reaction that investors have felt through the ages when prices move sharply against them.

This, of course, applies equally when there isn’t a bubble…

[1] Don’t believe anyone who tells you that the Internet bubble was caused by dumb individual investors – Institutions were out there speculating with as much abandon as any retail client.

[2] Unfortunately, in the extreme Zimbabwean version of events, a doubling of share prices only allowed the Investor to partially protect themselves. There is no real escape from Hyperinflation, which is a collapse in confidence in the underlying currency.

[3] Not wishing to blow our own trumpets here, (oh, all right then), but we have expressed similar views on this issue recently. Sadly, none of us will be retiring to the Bahamas on the back of them.

Disclaimer

We do not accept any liability for any loss or damage which is incurred from you acting or not acting as a result of reading any of our publications. You acknowledge that you use the information we provide at your own risk.

Our publications do not offer investment advice and nothing in them should be construed as investment advice. Our publications provide information and education for financial advisers who have the relevant expertise to make investment decisions without advice and is not intended for individual investors.

The information we publish has been obtained from or is based on sources that we believe to be accurate and complete. Where the information consists of pricing or performance data, the data contained therein has been obtained from company reports, financial reporting services, periodicals, and other sources believed reliable. Although reasonable care has been taken, we cannot guarantee the accuracy or completeness of any information we publish. Any opinions that we publish may be wrong and may change at any time. You should always carry out your own independent verification of facts and data before making any investment decisions.

The price of shares and investments and the income derived from them can go down as well as up, and investors may not get back the amount they invested.

Past performance is not necessarily a guide to future performance.