“I used to think if there was reincarnation, I wanted to come back as the president or the pope or a .400 baseball hitter. But now I want to come back as the bond market. You can intimidate everybody”. -James Carville US Political Commentator.

Bonds, like the companies that issue them, come in a bewildering array of forms, from the plain (Government bonds etc.) to the downright esoteric (High Yield, Municipal and even PIK varieties), but investors in all of them have to ask themselves, how confident am I that I will get my money back and (more importantly for the investor’s return on capital), when?

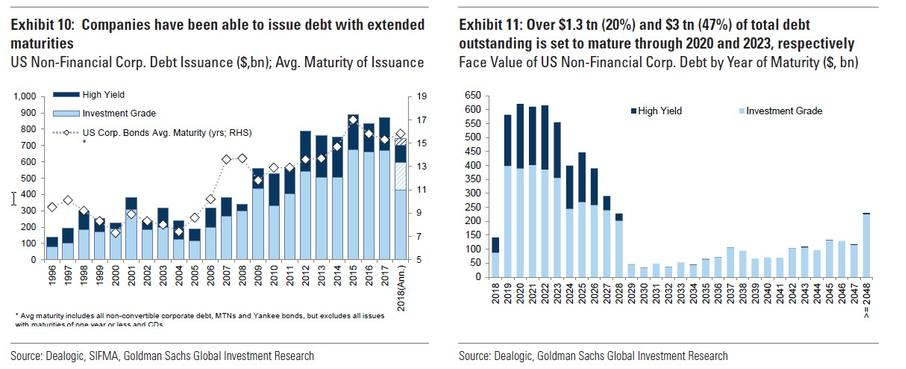

US Corporate debt levels have reached $6 trillion, with an increasing focus on Covenant-Lite loans, which we discussed (here) nearly 6 months ago and there is a large amount due to be repaid in the next 5 years (see chart below right). All this is relatively well-understood; even the Bank of England has weighed in on the issue of leveraged lending in recent months. It might not matter much in more normal times (if there is ever such a time), but with the Fed raising Interest rates, we may arrive at a point where Companies start to struggle to pay their debts on time and in full.

One area of interest is in the position of investors in bonds with embedded options, that is, the right of one party to impose an obligation on the other. These can be in the form of Call or Put provisions [1] and can have an impact on the price of the bond(s). They are primarily issued by Companies (though sometimes by Municipalities – Local Authorities as we know them) and they give them flexibility in their cash management processes, in return for which the investor may receive a slightly higher coupon for Callable bonds (and a slightly lower coupon for Putable bonds). In the case of the Putable bond, it is the Investor that has the option (to sell), which is (potentially) of value to them, resulting in an offsetting lower initial coupon.

For the firm issuing the bond, the value of the Call is, therefore;

The value of that Call (option) = Value of Conventional Bond (no Call provision) – Value of the Callable bond, or re-arranging the formula,

Conventional Bond = Value of the Callable Bond + Value of the Call (to the Issuer it would be positive, but it would be a negative value for the Bond buyer).

Consider a 10-year BBB rated bond, paying a 3% semi-annual coupon, with two years until the call date; a 2-year non-callable bond might have a yield to maturity of 2.7%, (and a price of 100.58), whereas a callable version might have a yield premium of c.0.6% to reflect the risk of the bonds being called by the issuer, thus having a price of 99.4 [2].

But what if the Firm either decides not to Call the bonds (or can’t)? This could be because market interest rates have risen, making the issue of a new replacement bond uneconomic, or as the above maturity schedule implies, they don’t have the cash to do so even if rates have fallen, because the market is not willing to effectively re-finance the previous loan. This creates a completely different problem for the investor;

If the bond is not called, it reverts to being an 8-year non-callable bond, which would yield around 4.71% currently, which translates into a price of 88.71, (you can do some “what if” calculations here). This would represent a price fall of nearly 11% , in the process wiping out nearly 4 years of coupon payments. The duration of the bond (and potentially the overall portfolio) would also rise significantly, from 1.7 years to around 6.3 years, which implies a significant increase in interest rate exposure [3].

There is nothing inherently wrong with investing in Callable bonds per se; the issue is whether the Yield-to Call (the yield assuming a Call does happen) is markedly different from the Yield-to-Maturity (when a Bond actually matures). If so, the investor could see a change in the yield component of the asset’s return and a lengthening of the Duration risk arising from the ownership of the asset. It is most likely to affect High Yield bonds as they have a larger tendency to feature embedded options in their debt mix and the longer the period between Call dates and overall maturity, the bigger the effect will be. Most fund managers use the “yield to worst” (the lower of the Yield to Call and the Yield to Maturity), so investors are likely to at least know of this risk. But it is always worth checking this…

[1] A Call Provision gives the Issuer the right (but not the obligation ) to buy back (or “call” in the jargon) the bonds at a pre-determined price. A Put gives the Bondholder a similar right to sell the bond back to the issuer (again, at a set price). The latter provision allows the investor to potentially limit their losses in a rising rate environment (which is why the investor receives a lower coupon), but the benefits of a Call Provision benefit the Issuer, as if Interest rates fall, the firm can buy back the bonds (and re-issue more at a new, lower rate of interest) – the investor is thus forced to re-invest the proceeds at a lower market rate, for which they receive compensation in the form of a higher initial coupon rate).

[2] As rates fall, the risk of the bond being called away from the Investor rises, leading to the Callable bond underperforming its’ conventional cousin. This phenomenon, which is common in bonds with embedded options is referred to as Negative Convexity and runs counter to the norm for bonds, which is that they rise in price as interest rates fall (and vice versa); but in this instance, the investor loses if rates fall further, so the bond price needs to reflect that risk (by underperforming non-callable bonds)

[3] The above are stylised examples- they correspond to current Corporate Bond Index yields and durations at both the 2 year and 8 year maturity levels, but these of course are subject to change.

Disclaimer

We do not accept any liability for any loss or damage which is incurred from you acting or not acting as a result of reading any of our publications. You acknowledge that you use the information we provide at your own risk.

Our publications do not offer investment advice and nothing in them should be construed as investment advice. Our publications provide information and education for financial advisers who have the relevant expertise to make investment decisions without advice and is not intended for individual investors.

The information we publish has been obtained from or is based on sources that we believe to be accurate and complete. Where the information consists of pricing or performance data, the data contained therein has been obtained from company reports, financial reporting services, periodicals, and other sources believed reliable. Although reasonable care has been taken, we cannot guarantee the accuracy or completeness of any information we publish. Any opinions that we publish may be wrong and may change at any time. You should always carry out your own independent verification of facts and data before making any investment decisions.

The price of shares and investments and the income derived from them can go down as well as up, and investors may not get back the amount they invested.

Past performance is not necessarily a guide to future performance.