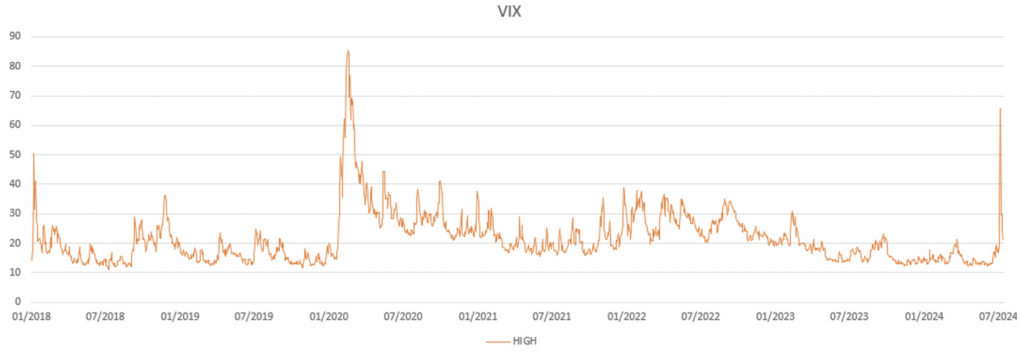

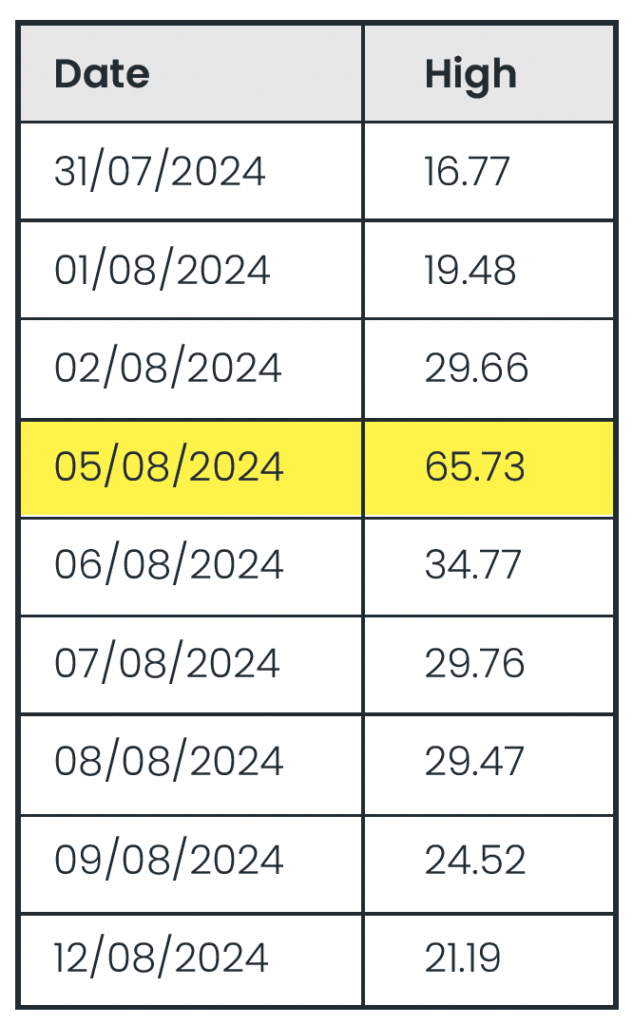

In recent weeks, financial markets have experienced extraordinary levels of volatility, as reflected by the VIX, or Volatility Index. On 5th August 2024, the VIX spiked above 65—a level it has only reached a handful of times this century. To put this into perspective, a VIX reading below 20 typically indicates stable markets, while a reading above 30 signals heightened investor anxiety, often during market corrections, crises, or significant geopolitical events. A VIX measure above 40 is considered extreme, so the recent peak at 65 highlights just how turbulent the market conditions have been.

VIX Highs since 2018

Source: CBOE

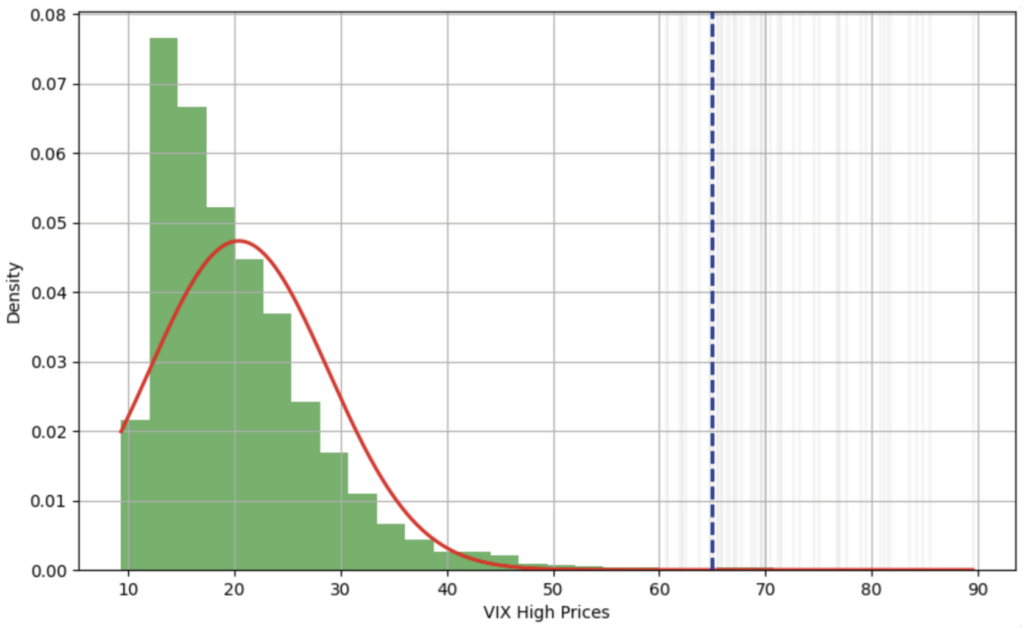

The histogram below shows the distribution of the daily highs from the VIX index since 2018, as you can see, a level surpassing 65 is very rare, only repeated during the COVID-19 pandemic in recent history. The blue dotted line represents the 5th August 2024 high. The grey lines represent previous highs above 60.

Distribution of VIX highs since 2018

Source: CBOE

The VIX: What It Tells Us

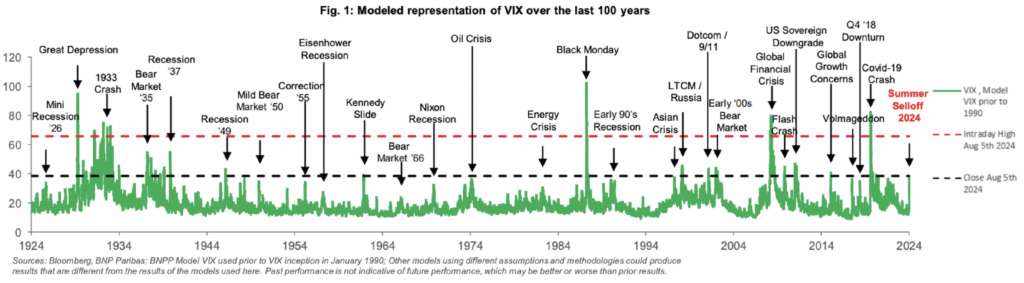

The VIX is often referred to as the “fear gauge” of the market. It is derived from the prices of S&P 500 index options and reflects the market’s expectations of volatility over the next 30 days. When the VIX is high, it suggests that investors are anticipating large market swings, whether up or down. Conversely, a low VIX indicates that investors expect a relatively calm market, below we can see 100 years of the VIX index (simulated prior to its launch in 1993), with higher levels usually coinciding with market crisis and significant geopolitical events.

100 Years of VIX

Impact on Trading Strategies

Weaker US jobs data sparked fears of a potential US recession and concerns that the Federal Reserve has been too slow in reducing interest rates. This situation quickly spiralled out of control, with most market observers believing that the market’s reaction was disproportionate to the initial fundamental triggers. The unwinding of yen carry trade, prompted by the Bank of Japan’s rate increases and the sell-off of the “Magnificent 7” stocks, along with the limited availability of hedging instruments, significantly contributed to the rapid market swings. Opinions vary, but many market participants attribute the recent spike to the forced liquidation of positions held by hedge funds, particularly those operating outside regulated markets, with algorithmic trading further exacerbating the movements.

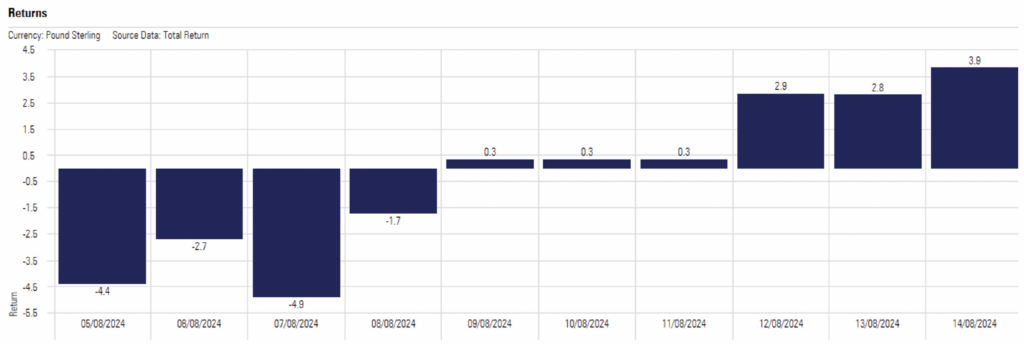

This unpredictability underscores a key point: while the VIX can signal increased risk, it does not provide a foolproof guide for when to buy or sell. For example, some might consider pausing trading during periods of elevated VIX levels. However, this approach is fraught with challenges. Markets can recover quickly, as seen in the recent case where global equities rebounded shortly after the VIX spike. If trading had been halted for a period, investors might have missed the opportunity to benefit from the recovery a few days later. Furthermore, the VIX index rapidly fell from 65 towards stable market values.

S&P Daily Returns (In GBP)

Historical VIX Highs (intraday)

Source: CBOE

The Limits of Prediction

The recent events in the markets serve as a reminder that even global institutions with vast resources and expertise can be caught off guard by sudden and sharp market movements. The idea of timing trades to avoid volatility is appealing, but in practice, it is extremely difficult to execute successfully. The VIX, while a valuable tool, cannot predict the exact timing of market swings, nor can it account for the complex interplay of global economic factors that drive those swings.

Long-Term Perspective

For long-term investors, particularly those employing buy-and-hold strategies, the key is not to overreact to short-term volatility. Regular contributions to investments and the benefits of pound cost averaging can help smooth out the impact of market fluctuations. While the VIX may rise and fall, staying invested through these cycles has historically proven to be a sound strategy.

Conclusion

In conclusion, while the VIX is a critical indicator of market sentiment and volatility, its value lies more in highlighting risk rather than providing clear trading signals. The recent spike in the VIX was an extreme event driven by a unique set of circumstances. As markets continue to process new information, volatility may persist, but trying to time trades based on the VIX alone is unlikely to yield consistent reliable results. Instead, a disciplined, long-term approach to investing, with an understanding of the risks and rewards, remains the best strategy for navigating volatile markets.

What else have we been talking about?

- January Market Review 2026

- Annual Market Review 2025

- Q4 Market Review 2025

- December Market Review 2025

- Highlights of 2025