How the US Government Shutdown Could (But Probably Won’t) Impact Investors

In 1980 the US attorney general Benjamin Civiletti ruled that non-essential (those which don’t protect life, property or national security) federal agencies must stop running if they didn’t receive funding. Strange as it may seem, up until then federal agencies would just keep going without a formalised budget, assuming that Congress would reach a consensus on funding sooner rather than later. Those days are long gone, and in what now looks like remarkable foresight of the expanding ideological chasm that has since opened up in US politics, Civiletti ruled that that this could no longer be the case. Hence, in the years since, there have been ten such shutdowns of varying length. On October 1st, the eleventh shutdown began. When it will end is anyone’s guess.

Naturally, when retail investors hear ‘government shutdown’, they worry that it might have a knock-on impact of economy, which has a knock-on impact on the financial markets, which has a knock-on impact on them. This is especially true when the country in question is the US, as it dominates the global equity and bond markets. Therefore, ebi thought it would be appropriate to write a short summary for our members of how shutdowns have impacted markets in the past, how they’re reacting to this one so far, and why it has the potential to go on longer than its predecessors.

Historical Impact of Previous Shutdowns on the Markets

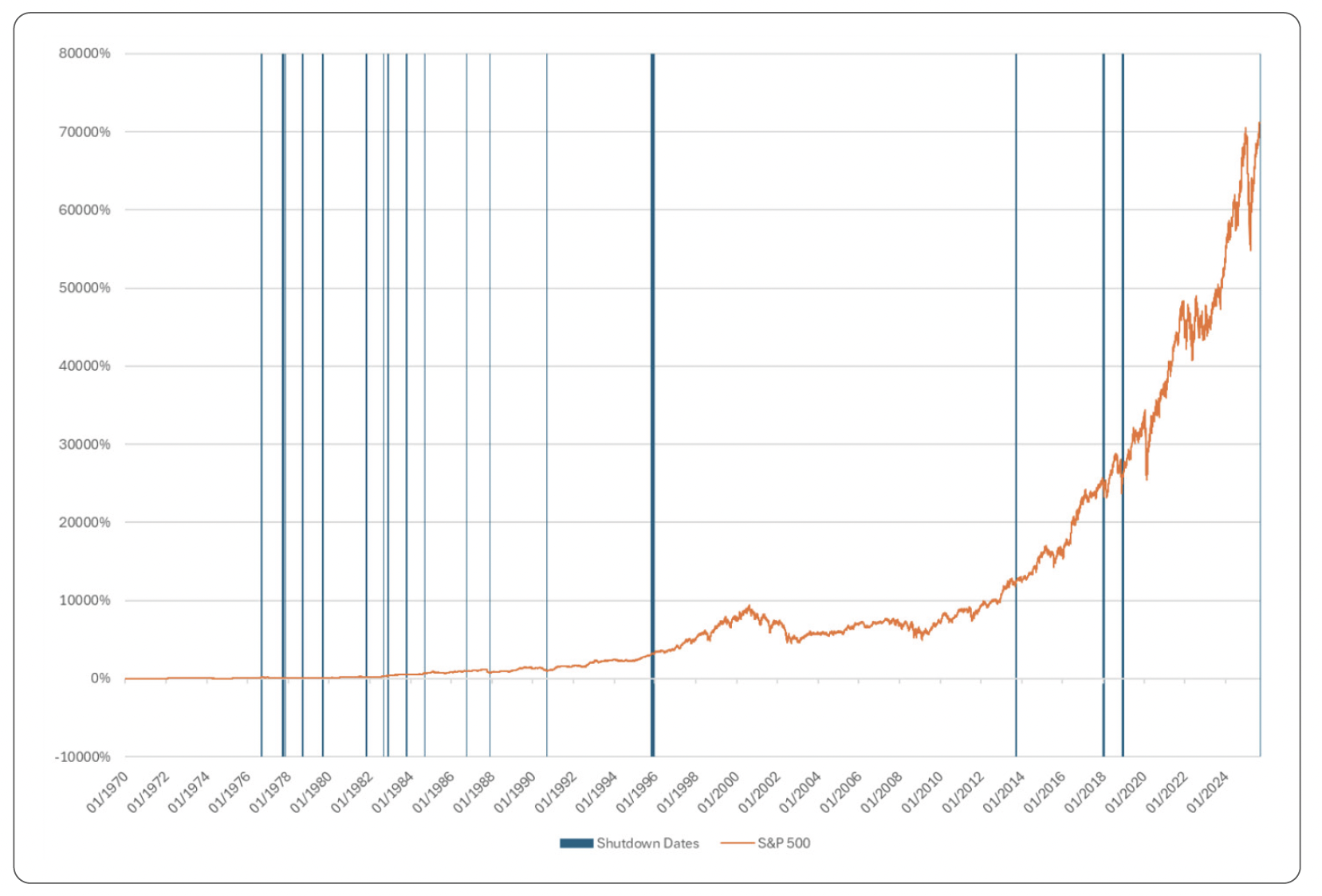

Most crucially, previous US government shutdowns have had little to no impact on the financial markets. This might feel odd, given the intimate relationship between the operating status of a government and its domestic economy, but it’s important to remember that in the entire history of government shutdowns only three have exceeded 15 days in length, and only one has lasted longer than a month. Over these timespans, there simply hasn’t been time for the impact of the shutdowns to trickle through to the performance of securities. This can be demonstrated by the graph below, which demonstrates the fleetingness of shutdowns when compared against the decades long march of market growth:

A chart demonstrating the relative transience of government shutdowns, compared to the long timescales of market growth.

y-axis: Growth in the S&P500 index since 01/01/1970

Past performance is not necessarily a guide to future performance.

*Source: Morningstar Direct, as at 30/09/25

Moreover, when equity market performance during the shutdowns is inspected, the results are mixed and anti-climactic, and whilst past performance is no indicator of future results, what’s certainly true is that government shutdowns are not always bad news for the equity markets. On the contrary, the performance of the S&P was over 6% during the last shutdown in 2018, indicating that there are other factors that the market takes more seriously in the short term than the funding of non-essential federal agencies.

y-axis: % return of S&P500 index

Past performance is not necessarily a guide to future performance.

*Source: Morningstar Direct, extracted as at 30/09/25

Naturally, bond markets react differently to equity markets in the event of a government shutdown, and the impact depends heavily on the context of the economic environment. Because investors have traditionally considered US treasuries to be the gold-standard of safe assets, demand for bonds has typically risen in the event of shutdown, driving yields down.

However, if shutdowns drag on and concerns are raised about missed payments, the yields on short term bonds (which are most likely to mature around potential default dates) can spike. Given worrisome economic indicators like the levels of government debt measured as a proportion of GDP (over 100% in the US), investors have been looking elsewhere for safety – most notably in gold, which has recently reached record highs. Were the government to remain shut down, this might help prolong gold’s impressive run. However, bond markets on the whole have too been largely unscathed by previous government shutdowns.

So why don’t shutdowns spell doom for the markets? Firstly, many of the agencies which are shut down have very little to do with the corporations that make up the equity (and a portion of the bond) markets. They administer public-facing services like national parks and museums – not very likely to show up on the S&P500. However, it should be noted that regulatory agencies including the Securities and Exchange Commission (SEC) are impacted, pausing inspections, enforcement and reviews. Perhaps more importantly, research and statistical bodies halt data collection and processing too, stemming the flow of economic data during the shutdown, meaning markets are ‘flying blind’ to a certain degree. These two examples highlight that the impact on the market is not zero, and would likely become problematic were a shutdown to significantly outlast its predecessors. In short, the answer to the question ‘Will the shutdown significantly impact the markets?’ can be succinctly answered as ‘They haven’t in the past, but could if this one lasts longer than expected’. Because shutdowns have historically been short, there’s no empirical data on what happens when they’re extended.

How the US Markets are Reacting to this Shutdown So Far

The US markets, having endured turmoil earlier in the year after the President announced his self-styled Liberation Day tariffs, have been somewhat muted in relation to the shutdown so far. While we saw a quick fall in markets following further announcements from President Trump in relation to the US’ trading relationships with China on Friday 10th October, as of the subsequent Monday confidence had returned somewhat, with the issue at hand being one other than the US government shutdown. Earlier in the month JP Morgan boss Jamie Dimon indicated on that there was a higher risk of a serious fall in US stocks than is currently being reflected, but these comments are a more holistic perspective on the state of the markets in general, given that unimpressive US economic data is out of lockstep record high stock market levels. The longer the shutdown goes on (and the longer analysts have to work without up-to-date economic data), the more a lack of confidence in the American economy might cause market jitters.

Why This One Might Be Different

With the midterm congressional elections scheduled for a little over a year from now, all parties involved in standoffs on spending levels might see an opportunity to position themselves and their voting record ahead of their forthcoming campaigns. There are also deeper political and ideological divisions within the Republican Party than there have been in previous years, which could make a resolution difficult to reach. The president, too, and his ‘never back down’ ethos, loom large over the Republican party. Nobody wants to back down.

Trying to predict how long a US government shutdown will last is akin to trying to time the market. You can make a guess (and you might be right), but unless you have information outsiders don’t, you’re essentially placing a bet based on news cycles and rumour. Moreover, as we’ve seen, the impact of previous shutdowns on markets has been mixed, so trying to navigate the shutdown to an investor’s advantage is likely to be unrewarding anyway. Leaving the markets might miss the type of boost that happened during the last shutdown.

ebi’s Perspective

ebi’s investment philosophy has always been to adopt a buy-and-hold approach, rather than letting market noise provoke impulsive decisions. We encourage investors to do what they can to shut out the noise and focus on the long-term.

Disclaimer

We do not accept any liability for any loss or damage which is incurred from you acting or not acting as a result of reading any of our publications. You acknowledge that you use the information we provide at your own risk.

Our publications do not offer investment advice and nothing in them should be construed as investment advice. Our publications provide information and education for financial advisers who have the relevant expertise to make investment decisions without advice and is not intended for individual investors.

The information we publish has been obtained from or is based on sources that we believe to be accurate and complete. Where the information consists of pricing or performance data, the data contained therein has been obtained from company reports, financial reporting services, periodicals, and other sources believed reliable. Although reasonable care has been taken, we cannot guarantee the accuracy or completeness of any information we publish. Any opinions that we publish may be wrong and may change at any time. You should always carry out your own independent verification of facts and data before making any investment decisions.

The price of shares and investments and the income derived from them can go down as well as up, and investors may not get back the amount they invested.

Past performance is not necessarily a guide to future performance.

What else have we been talking about?

- How the US Government Shutdown Could (But Probably Won’t) Impact Investors

- Q3 Market Review 2025

- ebi Spotlight: The Investment Team

- The FCA lifts its ban on Cryptocurrency ETNs

- September Market Review 2025