“When Cash is outlawed, only Outlaws will have cash” Bill Bonner (Bonner and Partners)

We seem to be stuck in Zero (or negative) Interest Rates, and market participants appear to be losing faith in Central Bank policies (see here also). This should not be a major surprise, as their ineptitude appears nowadays to be the norm not the exception, as can be seen by the announcement that, with BREXIT looming, the ECB (and the BOE) have pledged to support financial markets in the event of sharp price falls (which of course now transforms a “Leave” vote into a bullish event, and rather suggests who really loses if the UK departs).

Recent days have seen stock market weakness that has led to investors buying bonds at a furious pace. The 5 year German Bund has long sported a negative yield, but on Tuesday, the 10 year version did the same, having completed a 300 basis point (3%) fall in yield in just 4 years, as investors front ran Central Bank easing policies(1). (The Swiss now have negative yielding bonds all the way out to 2049 according to the Wall Street journal), and US 10 Year bond yields have also reached new lows. Government bond market liquidity is now so thin that the ECB has now embarked on buying Corporate bonds to make up the difference between what they promised to buy and what they actually could buy.

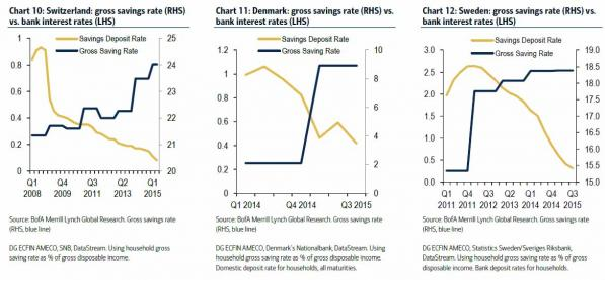

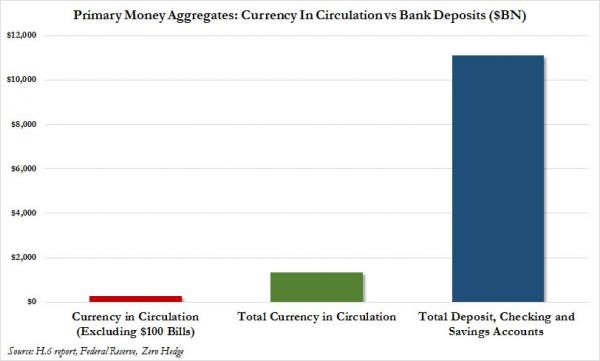

But as interest rates have slid ever lower, a strange thing has happened (see above) – savers are saving even more in response (as we said they might in this post). This is not what Central Bankers expected or wanted to see; so far, negative rates have only affected Corporate cash balances, but as the global financial system continues to slide ever closer to the abyss, it is probably only a matter of time before the BOJ, the ECB and the Fed cut rates again, and then savers could be paying for their current accounts. The obvious retort is that negative interest rates will unleash a torrent of cash withdrawals – indeed it appears to have begun, both in Japan and Switzerland. Thus far, banks have not imposed charges on personal current accounts, but the squeeze on interest margins will not allow that forever. In a world of fractional reserve banking, we could not ALL get into cash simultaneously anyway, as Steven Major of HSBC explains: “The assumption that bank deposits can be rapidly converted into cash does not hold up, in our opinion. If everybody wanted to take their cash out of the bank at the same time, the system would soon run out as there are simply not enough notes in circulation. It would take a considerable time to print the currency needed to meet the demand”, as currency in circulation is dwarfed by the potential demand. (See chart below). But to the extent that some are able to do so, the potency of monetary policy vanishes, which is Mario Draghi’s nightmare. So what’s the solution? Simply to ban cash…

This would need to be done carefully, so as not to frighten the populace: the first stage would be to limit the amount of cash payments allowed, then withdraw high value notes from circulation and follow that up with exhortations from establishment economists and commentators to ban the use of cash. In addition to solving the potential bank run problem, there would be other advantages – the black economy would almost completely disappear, as no cash transactions could take place (bad news for plumbers everywhere!), and it would enable governments to collect much more tax revenue (especially in Greece, which doesn’t appear to go in for that sort of thing normally). The need to get rid of negative-yielding money, bankers hope, will lead to a surge of spending, thereby reviving the economy. At a more insidious level, it would also enable more knowledge of, and potentially control over, individual spending decisions by the authorities, all of course in the name of “fighting terrorism”, whilst ensuring there is no limit to how negative rates can go – would you rather spend money or pay -10% rates?).

In the month post the Davos meeting (February), of the great and the (not so) good, there were a number of speeches, editorials and so on extolling the virtues of banning cash (see here for a list of examples). Of course, given that a large minority of consumers already use electronic transactions to make purchases it should be easier to achieve, regardless of the liberty implications. The younger generation appears much more relaxed about being cashless than are the older generation, (possibly because the latter can recognise a scam when they see one!), so it may not create too much fuss (rioting pensioners does not seem a likely scenario).

So what are the implications? Leaving aside the civil liberties aspect of having Central banks (and by extension the state), gaining access to, and potential control over individuals personal financial data, the main effect may be to concentrate investor’s minds. It would not be a major leap to imagine that they will want to go “off grid” to a certain extent, buying real assets (Real Estate, Gold and Silver, and most likely Equities). It provides an escape route from negative yielding bonds, potential future inflation risk, and the prospect of some sort of a real return. Pension funds are struggling mightily with the elimination of a risk-free rate of return, as we discussed in April. In this context, it may well be that for large pension schemes and the Global Asset Allocators, equities are “the only game in town”, almost regardless of valuations. The alternative is bankruptcy.

(1) Front Running refers to the practise of Traders of buying the assets that they believe the Central Bank is about to buy hoping thereby to profit from the resulting rise in prices caused by the latter’s purchases. It is in no way an economically productive exercise, but very good for trader bonuses!

An interesting blog post by employees of the New York Federal Reserve gives an insight into what negative rates may do in the absence of cash controls. The idea of trying to pre-pay bills and not getting anyone to accept it is faintly amusing.

Post Script: In September last year we wrote a blog asking whether Corbyn’s Labour could actually win a general election for Labour; given the nature of the referendum campaign and the bitterness displayed it is now becoming clearer how this could happen. It is not easy to believe that the Conservatives can re-unite post referendum (either way), and we know from history that divided parties rarely win elections. Corbyn is by no means seen as an insider (despite 30 years in Parliament), and could benefit from the perception that the elites are “all in it together”. As of 17/6, the best odds on Corbyn are 10/1. George Osborne is 9/1…

Disclaimer

We do not accept any liability for any loss or damage which is incurred from you acting or not acting as a result of reading any of our publications. You acknowledge that you use the information we provide at your own risk.

Our publications do not offer investment advice and nothing in them should be construed as investment advice. Our publications provide information and education for financial advisers who have the relevant expertise to make investment decisions without advice and is not intended for individual investors.

The information we publish has been obtained from or is based on sources that we believe to be accurate and complete. Where the information consists of pricing or performance data, the data contained therein has been obtained from company reports, financial reporting services, periodicals, and other sources believed reliable. Although reasonable care has been taken, we cannot guarantee the accuracy or completeness of any information we publish. Any opinions that we publish may be wrong and may change at any time. You should always carry out your own independent verification of facts and data before making any investment decisions.

The price of shares and investments and the income derived from them can go down as well as up, and investors may not get back the amount they invested.

Past performance is not necessarily a guide to future performance.