“When you get something for nothing, you just haven’t been billed for it yet” -Franklin Jones Journalist 1908-80.

The Great and the Good of Central Banking meet for their Annual Get-Together at Jackson Hole in Wyoming to discuss the issues of the day, which include how to exit their Bond purchasing programmes amid “unease” concerning the almost complete lack of Inflation despite their efforts to reflate economies in Japan, Europe and the US. Investors are now watching closely for signs of an imminent exit from QE, from both the Fed and the European Central Bank (ECB), as, if bond buying reduces (and then stops altogether), markets are bound to be affected.

Just as Central Bankers are looking for the exit door, the surprisingly strong showing of Jeremy Corbyn in the recent General Election has once again brought up the subject of “Peoples QE”, an idea first espoused during his Leadership campaign. At the time, it could be easily dismissed as the economic illiteracy of a fringe candidate, but he is no longer that, (or at least he is no longer a fringe candidate), (and this week’s revelation that the Conservatives are already back-tracking on plans to reform Executive pay will not hurt his chances one iota).

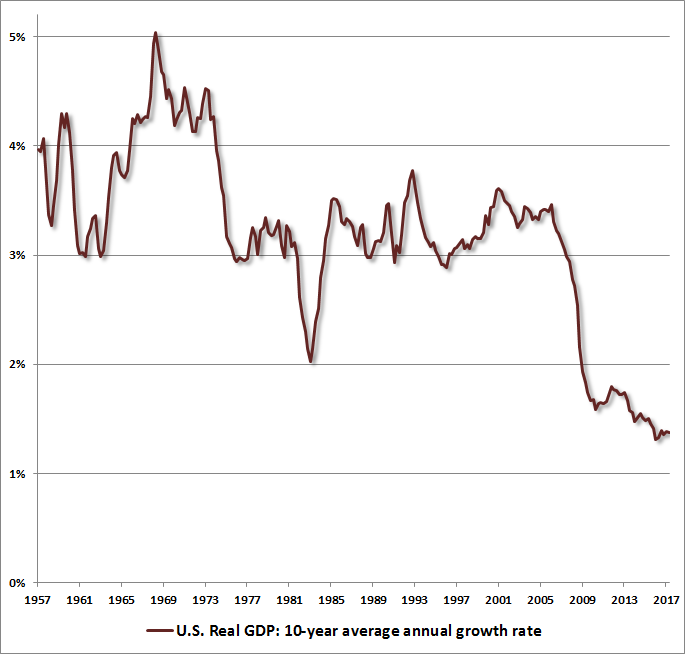

So it makes sense to see what his QE would look like and what it might achieve, since he could be in power sooner than most thought possible. The chart below demonstrates that the current version of QE has had no positive effect whatsoever on the underlying growth trend in the US, (though it has contributed greatly to the widespread overvaluation of all financial assets) and everywhere else for that matter; what is different about Corbyn’s idea?

The proposal is not new; Milton Friedman has long advocated a variant of this policy, whereby the Central Bank prints money and distributes it directly to the people (evocatively called Helicopter Money), in the form of a cheque or more likely a direct transfer to bank accounts. This would occur when Interest rates reach the “lower bound” (i.e .zero), thus becoming ineffective in stimulating demand. But in Corbyn’s policy. It is the State, not the Individual that gets the benefit of the cash.

Instead of using the Bank of England to buy Gilts, Corporate bonds or other financial assets, the Government would instruct them to print a certain amount of money, which would then be used to buy Bonds issued by a “National Infrastructure Bank”, which would then invest the money in projects such as a nationwide High Speed Broadband system, or a more modern transport system, Green energy projects, new housing, hospitals, schools or anything else that the Government in its wisdom deems necessary. After all, interest rates are at near zero levels, labour is relatively cheap and the private sector are reluctant to invest in these sorts of things.

The first implication is that the BOE loses its independence, which has been a key plank of monetary policy since Gordon Brown “released” it in 1997. The idea was to free it from Governmental control, thereby enhancing the credibility of monetary policy. Under Corbyn, this would end, with the Bank becoming another Government agency, printing money on command, and being forced to buy all the bonds issued by whatever Institution is in charge of the “investment” programme. Cue a raft of white elephants (Millennium Dome?), done for political rather than economic reasons.

This wasteful spending, which of course will exceed the original spending budget, would crowd out any private sector investment and almost certainly lead to inflation, as deficits rise without any corresponding increase in real economic return; after all, the taxpayer would be on the hook for losses, so there is no incentive to remain efficient, because they can pass the costs on to the private sector via currency declines (and thus inflation). The supply of goods and services may rise overall, but it’s not likely to be those that the market actually wants ; the gap will be filled by imports, leading to a fall in productivity, increased budget shortfalls and ultimately tax rises, which further increases the mis-match between supply and demand.

It will look like Venezuela, or even worse Argentina circa 1998-2002. It has been tried countless times and failed every single time, leading to crisis (and a trip to the IMF for another bailout?). The idea that Governments know better than the private sector what the economy needs is falsified simply by the fact that there is no incentive for them to find out [1].

It could be that the British are going to have to re-learn history – it is perhaps no coincidence that it was the young who voted heavily for Corbyn; they weren’t around in the 1970’s and so have no idea what it looked (or felt) like. But this time will not be “different”, these experiments always end the same way.

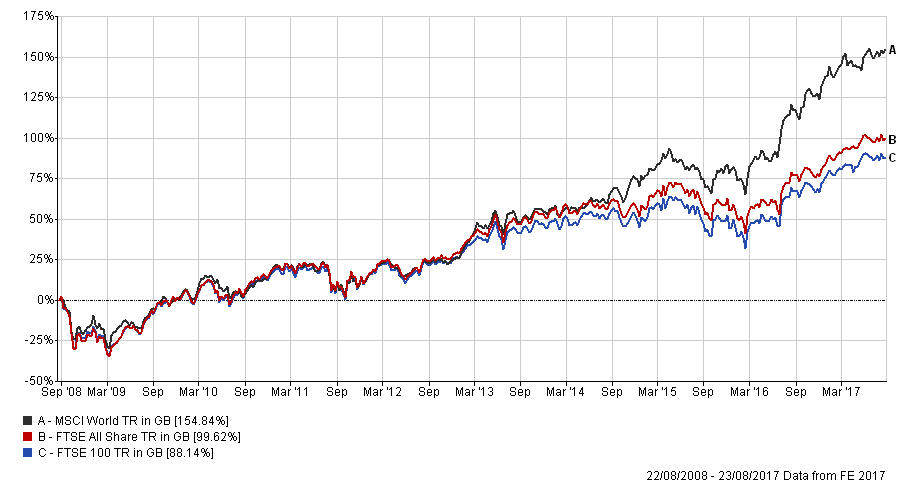

For UK investors, the potential warnings are clear: the sharp under performance of UK equities, relative to their Global counterparts could get much worse under anything approaching the scenario outlined above [2]. The chart shows that the divergence between the UK and the MSCI World Index began to emerge around the last major low point in the US Dollar Index (June 2014) and has only got bigger in the last 3 years.

The Sterling Trade weighted Index has fallen 21% since July 2015, such that UK equity returns expressed in non Sterling terms have fallen sharply (which will tend to put off foreign investors). The nominal value of UK equities has been maintained, (the All Share Index is +21.5% in that time), but the real return (i.e. in purchasing power terms) has thus been zero. Meanwhile, overseas markets have been rising in both nominal AND real terms (as their currencies have mostly risen vis-a-vis Sterling).

If investing means anything, it is about the growth of assets (if one is only interested in maintaining ones net worth, there is no need to invest in equities at all). So it is important, to have a broad spread of assets across the globe, rather than in one market. As markets begin to discount the possibility of Corbyn’s victory, it may be too late to wait for the election result.

In our Newsletter of 7/8/17, we announced that EBI have launched Global Portfolios to address this issue, which are now available via a number of the platforms our advisers currently use, (including Wealthtime and Transact, but others will soon follow). It may be time to start looking at this possibility more closely, as the prospects for Sterling darkens. More details can be obtained from our office.

[1] The objective of Socialism generally is to maximise government expenditure (and thus control of the economy-for themselves), NOT to promote efficiency and productivity. At least private sector operators (in theory) bear the costs of their investment errors and so have an incentive to be prudent. (I did write, “in theory”).

[2 To take a purely hypothetical example, suppose that the market currently assigns a 46% probability of a 5% market gain, a 46% chance of it remaining at the same level and an 8% chance of a fall to 5000; this gives us an expected price of 7413 for the FTSE 100 Index, which currently resides at 7436. (7808 x 46% = 3592+ 7436 x 46% = 3421+ 5000 x 8% = 400). Assume that the odds of Corbyn victory rise to 30% (with an equal drop in the odds of the other outcomes); this gives us an expected Index level of 7808 x 35% + 7436 x 35% +5000 x 30% = 6836, a drop of 8% from current levels. Investors will have little time to react should those probabilities change again for the worse.

[Please note, this is not a forecast, merely an illustration of how a price fall might occur as a result of rising expectations of a Corbyn victory and what that might do to UK economic prospects].

Disclaimer

We do not accept any liability for any loss or damage which is incurred from you acting or not acting as a result of reading any of our publications. You acknowledge that you use the information we provide at your own risk.

Our publications do not offer investment advice and nothing in them should be construed as investment advice. Our publications provide information and education for financial advisers who have the relevant expertise to make investment decisions without advice and is not intended for individual investors.

The information we publish has been obtained from or is based on sources that we believe to be accurate and complete. Where the information consists of pricing or performance data, the data contained therein has been obtained from company reports, financial reporting services, periodicals, and other sources believed reliable. Although reasonable care has been taken, we cannot guarantee the accuracy or completeness of any information we publish. Any opinions that we publish may be wrong and may change at any time. You should always carry out your own independent verification of facts and data before making any investment decisions.

The price of shares and investments and the income derived from them can go down as well as up, and investors may not get back the amount they invested.

Past performance is not necessarily a guide to future performance.