The first Quarter of 2020 was the poorest equity market performance since 2008 for the S&P 500, but that was not the weakest asset class.

The oil market had a truly dreadful 3 months, falling by a massive 66%, its worst ever quarterly return. The refusal of Russia to agree to cuts in oil output levels by OPEC+, the OPEC nations plus Russia, led to Saudi Arabia discounting their oil prices and gearing up oil production to force prices lower.

Aramco, the state-owned Saudi oil firm, has been instructed to boost oil supply from 9.7 million barrels per day (bpd) as of March to 12.3 million bpd in April, not far short of its 13 million bpd maximum capacity, as they engage on an all-out price war with Russia. Some have interpreted the decision as an attack on the US Shale industry, which has a break-even production price of about $60 a barrel and which has propelled the US to independence from importing oil. This may have been the motivation, but in combination with the COVID 19 outbreak which has led to a huge demand shock, they have succeeded in pushing prices of Brent crude down to just under $25 [1] per barrel and West Texas oil down to below $20 at one point.

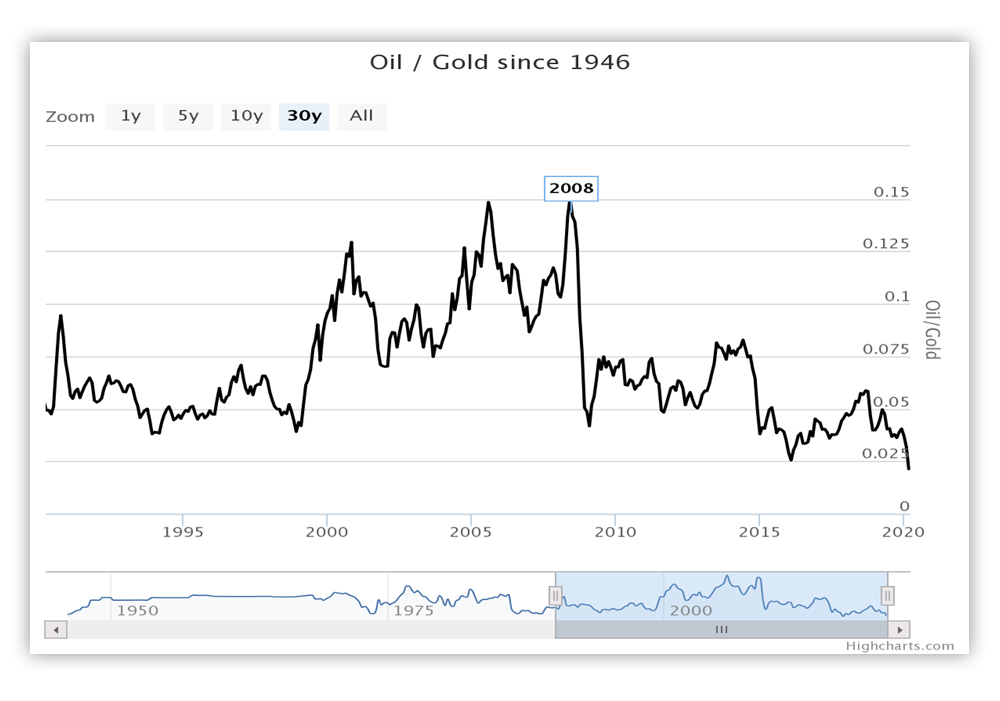

How cheap is oil relative to other assets?

It is at all-time lows relative to Gold.

Source: Highcharts.com

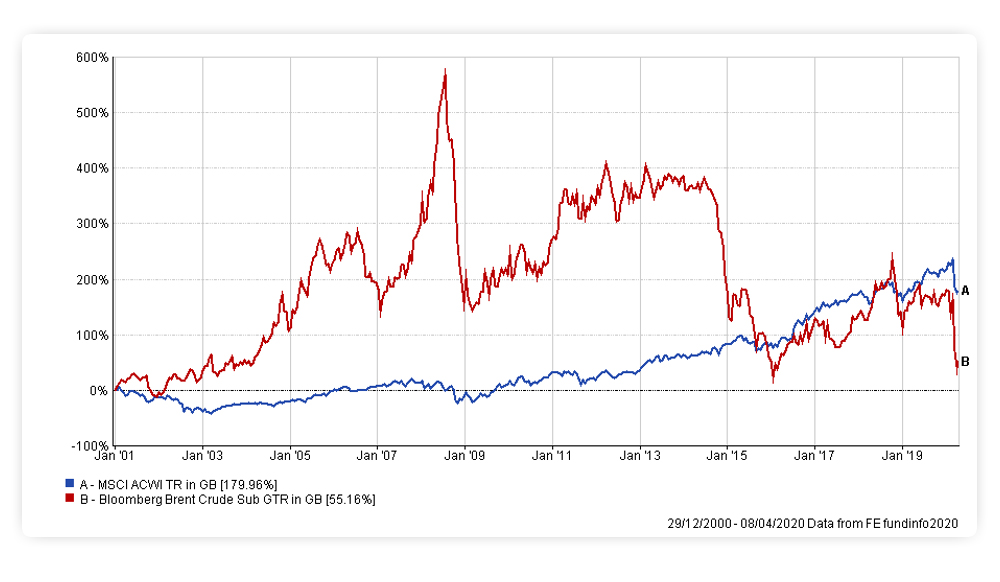

Relative to equities, it has had a pretty disastrous 5 years or so, fully unwinding the effects of the oil price surge in 2008-09.

It may turn out to be an apocalyptic April, as over-supply hits the point where oil storage capacity is reached. According to Mizuho Banks’ Paul Sankey, total US storage is at present around half full and can accommodate 135 million barrels more oil. At a build rate of 3 million bpd, that gives the industry just 6.5 weeks of potential storage space. At that point, oil producers will have to pay someone to take their oil.

This is happening in real time; some Canadian grades of oil, the Western Select grade for example. fell to just $4 a barrel at the end on March, whilst Wyoming Sweet oil hit $3 per barrel according to Bloomberg. Both Canadian and Wyoming oil fields are land-locked regions, with limited access to pipelines to take oil to market, meaning that as storage capacity fills up, they become forced sellers, as they are unable to store it themselves.

Logistics, as much as location, will determine marginal pricing for these grades of oil; it is therefore possible that oil prices in some regions and grades could go negative. In contrast, Brent Crude is likely to remain relatively resilient, the same could be said for both Saudi and Russian oil.

This could have immense political implications for the US President, as oil shale firms, already deep in debt, could be forced into bankruptcy, as nearly all oil types are now at cash cost. More than 5% of all US jobs are directly dependant on the oil and gas industry and nearly twice that are indirectly related.

Trump has already tried to reconcile the feuding oil nations, but neither shows signs of changing their approach.

Trump’s announcement, via a tweet on the 2nd April, that the Russians and the Saudis would cut production by between 10-15 million bps led to a 25% price rise, the biggest ever one-day gain, but this looks ever less likely. Once market participants realise that this is not a viable process, the vicious short squeeze that we have just seen may well reverse once again.

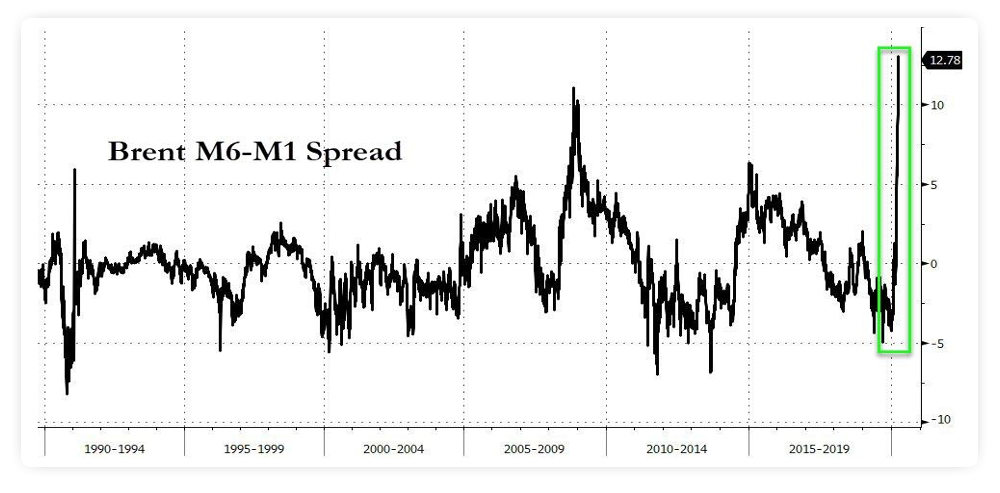

There is an old market saying that the best cure for low oil prices is low oil prices, meaning it is self-correcting. How might this happen? Luckily, there is a market- provided solution, which presented itself last week in the form of a massive contango in the oil market [2]

The spread between spot oil and those for delivery in one year [3].

How does this work in practice? Traders can buy spot oil and simultaneously sell the forward month, in this case November oil futures, and pocket $12.78 while they wait. There will be virtually no financing costs (as interest rates are essentially zero), but storage costs will be high as shipping/tanker rates have been rising steeply, partly in response to this arbitrage activity.

A 2-million-barrel purchase of oil, which corresponds to the capacity of a large crude tanker, would yield a $2.5 million profit [4] with limited market risk. Even after the near 40% rally off the $25 lows of early April, Brent crude for November 2020 still has about a $6 contango priced versus spot at the time of writing.

A more radical and non-trading approach might be for the President to impose an imported oil fee. He does have the authority to do this, which would involve setting a “base price” for oil and imposing a charge on imports below that price equivalent to the difference between the actual price and the base price. So, if the base price was $40, and the import price was $30, a fee of $10 per barrel would be levied. This would set the world oil price at $40, since no oil company would be willing to sell below that level, and would effectively “bail out” the US shale industry, as imports would presumably be drastically reduced. This should be seen as a nuclear option however, as it would inevitably inflame tensions amongst other oil producing nations, potentially leading to unintended outcomes.

Things are rarely quiet for long in oil markets. In a paradoxical twist, it may be that the real loser in all of this is renewable energy. What was an economically viable competitor to oil at $50 is no longer so at $30, implying a reduction in potential investment in solar, wind and hydroelectric power projects. As political concerns about the extent of the COVID-19 outbreak and its knock-on effect on economic growth rise, the incentive to divert expenditure towards stimulative programmes could lead to “green” projects being put back. It may be a long time before environmentally friendly energy investments gain the traction they had hitherto.

[1] There are 42 gallons of oil in a conventional “barrel” of oil. At $25, (and an exchange rate of $1.24), a gallon of oil now costs £0.48; meanwhile last week, I paid £1.05 a litre for petrol at my local Tesco.

[2] Contango refers to the situation where spot prices are above that of futures prices. In contrast, backwardation is where futures prices are below spot prices. The contango should not exceed the cost of carry (store, insurance fees etc.). If it does so, a risk-free profit opportunity arises.

[3] In the chart above, M1 refers to month one (in this case May 2020), while M6 refers to 6 months ahead of that, which is November 2020. The chart shows that the price for November delivery is $12.78 above that of the one-month forward price.

[4] 2 million barrels x $12.78 = $25.56 million outlay. Assuming a 10% return for the trader, that yields a profit of c. $2,556,000 after all costs. The tanker owner makes the bulk of the money.

Disclaimer

We do not accept any liability for any loss or damage which is incurred from you acting or not acting as a result of reading any of our publications. You acknowledge that you use the information we provide at your own risk.

Our publications do not offer investment advice and nothing in them should be construed as investment advice. Our publications provide information and education for financial advisers who have the relevant expertise to make investment decisions without advice and is not intended for individual investors.

The information we publish has been obtained from or is based on sources that we believe to be accurate and complete. Where the information consists of pricing or performance data, the data contained therein has been obtained from company reports, financial reporting services, periodicals, and other sources believed reliable. Although reasonable care has been taken, we cannot guarantee the accuracy or completeness of any information we publish. Any opinions that we publish may be wrong and may change at any time. You should always carry out your own independent verification of facts and data before making any investment decisions.

The price of shares and investments and the income derived from them can go down as well as up, and investors may not get back the amount they invested.

Past performance is not necessarily a guide to future performance.