You may not have heard of Modern Monetary Theory, but you soon will do; it is becoming increasingly popular in the US as the “democratic left” searches for an alternative narrative to that of Donald Trump and a way to harness popular discontent with the way capitalism appears to be working. As we have discovered recently, economic illiteracy is no barrier to popular acceptance and though this ideology is clearly of that idiom, it does look set to go mainstream in the run-up to the next Presidential election, set for November 2020. I will not attempt to debunk the theory itself (as my view of it is entirely independent of the likelihood of its’ coming to pass) but instead look at the consequences for asset prices in general should it do so. Forewarned is most definitely forearmed.

So what is Modern Monetary Theory (MMT)?

At its core, the theory posits that a country that has its own currency has the freedom to allow government spending without any impediment, subject to the proviso that such expenditure does not create inflation; there is thus potentially no limit on what the state can spend, as they have a monopoly on money creation and can “print” whatever they need to pay all debts, pay employees wages and (if necessary) buy all goods in the economy to ensure growth is maintained at the appropriate level. Only when state spending begins to compete with the private sector (so-called “crowding out”), in the acquisition of resources (which would lead to generalised inflation) would it have to call a halt. As long as it does not borrow in a foreign currency, the government can always pay its debts (via the printing press). Of course, this sounds like a rationalisation for the role of increased state intervention in the economy (which it is), but it is possible to argue that this is what the Fed is doing now in financial markets. It is a world without end of increased (state) expenditure, as efforts to balance the budget are not only futile but harmful, as it prevents the resolution of problems such as widespread poverty, a lack of affordable healthcare, crumbling infrastructure and the continued stagnation in economic productivity etc. In this variant of current policy, proponents argue that we would replace fiscal austerity and monetary laxity with fiscal expansion, which implies that the focus of the government would be on the real economy, (rather than the S&P 500’s closing price which it appears to be at present) [1].

Whatever the rights and wrongs of this view, it is clearly in tune with the zeitgeist. The election of Donald Trump signalled a dissatisfaction with the status quo as many feel they have seen no benefit from the US economic growth in the period post 2009, with one recent US opinion poll suggesting that some Democratic politicians’ ideas for raising taxes on “the rich” to 70% plus have widespread support (76% of registered voters are in favor of the idea – though not necessarily for themselves as this satirical piece highlights). Fox News (most decidedly NOT a left-leaning network) found that most Republicans agree with it too. Marco Rubio, a Republican Senator has proposed ending the tax benefit of share buybacks (which leaves one wondering who will buy the dip from then on?), an additional indication that the Overton Window may be shifting.

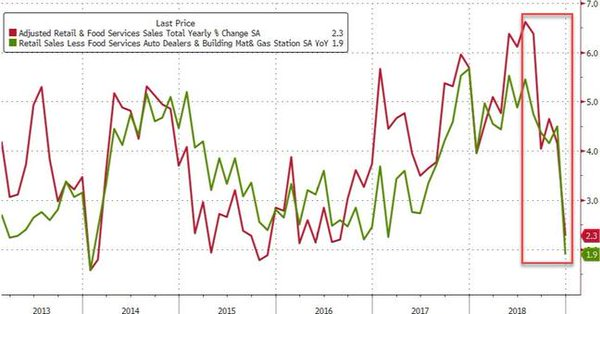

What are the implications of the adoption of this policy? If it is implicit in the concept that inflation is the main goal, there is a very strong chance they will reach it; the first instinct would be to sell ALL bonds and load up the truck on equities. But second order thinking is necessary here – equities are clearly a hedge against inflation as long as they have pricing power. But not all of them do – Apple appears to have reached a peak in $1,000 phone sales and consensus US earnings expectations are falling hard, from +6.7% growth in September 2018 to -0.8% as of early February 2019, which suggests that debt-soaked consumers (both in the US and here) may have been showing more spending restraint than in the past, possibly to avoid personal insolvency. It appears that this has been on-going for most of the second half of 2018.

Rampant inflation is not a given, however: there were many prophecies of an inflationary dystopia when QE was announced, which failed completely to materialise, aside from in asset prices. Post-hoc theories were advanced to explain this inconsistency, but none were proffered at the time of its implementation. If one borrows/prints money and makes no effort to pay down the debt, at some point interest payments would constitute 100% of the debt, which would necessitate printing yet more money to pay that off (and so on etc. etc.)

What may be more likely is that Inflation (if it appears at all), will be in the “real world” rather than the financial casinos of Wall Street and EC2 [2], (which will no doubt explain the knee-jerk hostility of financial analysts). If so, that suggests that all/most financial assets may take a hit, through the inflationary effect on the real economy, as interest rates rise and earnings sag under the competitive pressures from “zombie” firms – those that could not survive in more “normal” times but are (just about) able to keep going and need to sell at almost any price to continue to do so. Thus, the deflationary impulse would continue.

All this creates a problem for asset markets in general; we (and everyone else) have not seen this before. According to one Bloomberg article, the average age of a trader on Wall Street (in 2015) was around 30 – that number will have fallen further since then, due to retirements, but even if we assume that it is now 34, the majority will have no memory of the Dot-com bubble and will have spent more than half of their careers with near-zero interest rates as a backdrop. They will have no idea what to do if MMT comes to pass (but neither will anyone else for that matter).

Will it actually happen? The lobbying power of the financial world will move heaven and earth to make sure the idea is dead on arrival post the next Presidential election, so it is just as likely that it will be neutered on politically, as it clearly ends the QE party that has been going on for a decade or so, (much to Wall Street’s benefit).

We shall just have to wait and see. Global politics have sprung many surprises in the last 3 years or so, meaning that full-scale adoption of MMT is not out of the question, but it would not be wise to second guess events as it is still a “long tail” event. That does not mean that EBI won’t be watching closely though…

[1] To dig deeper into this, one might start by reading some of the articles by Stephanie Kelton, a rising star in this firmament, who is a Professor of Public Policy and Economics at Stony Brook University (in New York) and a former economic advisor to Bernie Sanders’ presidential campaign in 2016. Another proponent worth reading or listening to is Professor Steve Keen.

[2] The postcode of the Bank of England.

Disclaimer

We do not accept any liability for any loss or damage which is incurred from you acting or not acting as a result of reading any of our publications. You acknowledge that you use the information we provide at your own risk.

Our publications do not offer investment advice and nothing in them should be construed as investment advice. Our publications provide information and education for financial advisers who have the relevant expertise to make investment decisions without advice and is not intended for individual investors.

The information we publish has been obtained from or is based on sources that we believe to be accurate and complete. Where the information consists of pricing or performance data, the data contained therein has been obtained from company reports, financial reporting services, periodicals, and other sources believed reliable. Although reasonable care has been taken, we cannot guarantee the accuracy or completeness of any information we publish. Any opinions that we publish may be wrong and may change at any time. You should always carry out your own independent verification of facts and data before making any investment decisions.

The price of shares and investments and the income derived from them can go down as well as up, and investors may not get back the amount they invested.

Past performance is not necessarily a guide to future performance.