[The events of Tuesday/Wednesday has necessitated a substantial re-write of this blog – once again, markets have been wrong-footed by a massive underestimation of public mood. If it reads as if I am gloating a bit, it is because I most definitely am].

Where’s my boy @JebBush at? Clinton’s and Bush’s finally kicked out of politics. Phillip Taylor tweet 08.48 am. 09/11/16.

“They would not listen, they did not know how

Perhaps they’ll listen now.”

Don McLean – Vincent

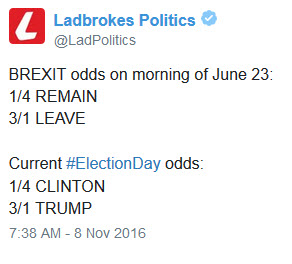

Before the result on Tuesday, I found the following screenshot – notice anything similar?

In an almost carbon copy of the Brexit fiasco, the US electorate have overturned conventional expectations, and elected D. Trump as the 45th US President. There is a lot of embarrassment amongst a lot of different sections of what could be termed “the establishment” which in itself is worth the price of admission. On 9/11, is the US political class experiencing its “Twin Towers” event?

In short – yes. Nassim Taleb (here) refers to the IYI (Intellectual Yet Idiot) political class, those Establishment Insiders, who bear no personal consequences for their policy failures, yet who delight in telling the rest of us what to 1) do, 2) eat 3) how to think 4) speak and 5) who to vote for. They believe themselves uniquely qualified to both articulate AND carry out other’s best interests, particularly those of the lower classes. When confronted by alternate views, the first response is to brand those as ignorant or racist or “nativist”; thus calls for the UK Parliament “to have a greater say” in Article 50 really means preventing it, as it is not a result of democracy but “populism”.

The Washington Post today put it succinctly enough: “Voters are angry at the failure of elected officials in Washington to listen to them and act. They are angry that the country can’t secure its borders. They are angry about a war on terrorism that has dragged on for more than a decade and has shown more signs of defeat than victory. They are angry at the arrogance of the rich and well educated who don’t seem to know – much less care – that working people’s standard of living has been declining for a generation. (see here)They are angry at the media, at journalists they think look and sound too smug, too certain, and too aloof. They are angry at the “new economy” that trumpets apps and functionality and brags about the “costs” (read: jobs) that are being eliminated. They are angry about being mocked and vilified as rubes, racists, and “deplorable.” They are white-hot angry that their children don’t have reasonable prospects for advancement”.

Large numbers of Americans (see this Reuters poll), are deeply unhappy with the political system, and, just as in Brexit they want real change, (not the inertia of Obama or Cameron).

But they are but the most prominent in a long list of losers from this phenomenon. In no particular order, they include Wall Street generally and Goldman Sachs in particular (who haven’t contributed campaign funds to Trump and thus now have absolutely no influence whatsoever), and the Corporate elite who have also now seen their lobbying power (via campaign contributions) sharply eroded. The Saudis too, (who contributed heavily to the Clinton Foundation in the hope of getting the Americans to help oust Syria’s President Assad), now look out in the cold, as do the Europeans who now face the prospect of having to pay more towards their own protection (via NATO). The silence from Europe has been deafening – a sure sign that they are apprehensive.

There is however, a special place in political hell is reserved for the Media, and self-appointed “expert” opinion pollsters, who failed utterly to get even close to how Americans intended to vote – believing opinion polls derived from Internet surveys, or by “oversampling Democratic voters or minority groups [1]. Like in the UK with Brexit, city-centric and oh-so-trendy liberal media types, who so desperately wanted to believe Hilary would win, were convinced that no-one would vote for a man who hurled insults around, and who wouldn’t disclose his tax return: thus he could not possibly win. Surrounded by like-minded opinions and in a self-referential bubble of their own making, they failed to notice that the “great unwashed”, who don’t live in cities, don’t go to wine bars, don’t eat falafel, are more concerned with place availability in local schools and hospitals than the plight of the minke whale. Only the Media and the pollsters appeared to be shocked by the result as if Twitter somehow represented the mood of the nation [2].

The near-election of Bernie Sanders, an avowed socialist, to the Democratic nomination, should have been a warning, but it wasn’t heeded because they weren’t truly listening. The early indications are not encouraging- some of the Tweets suggest that they haven’t learnt anything…

This fallibility is of course mirrored in the markets. Predictions of “Trumpageddon” have only come to pass for long duration bond holders (and equity short positions). Since Wednesday morning, the Dow Jones index is up 1300 points. To be fair, if you get the election winner wrong, the chances of picking the right stocks/sectors etc. does diminish sharply, so the question is begged – why try? Or why follow those that try? The markets (and the economy) march to their own beats and are not as amenable to prediction as pundits seem to think. This of course doesn’t deter them, but don’t expect any support or advice if they are wrong – they will have moved on to the next “sure thing”, and you are on your own.

Perhaps we expect too much from experts of all types – they, like Corporate CEO’s, are much less in control and have much less knowledge than they would care to admit. Was Jimmy Carter really that much worse than Reagan as President? More likely, he was just unlucky enough to be in-situ at a particular point in time. Like Hoover in the 1930’s Depression, he took the blame for things almost completely out of his control – after the initial tantrum, markets seem to be surging and will return to looking at the economy for clues to future direction. Just don’t expect experts to give you the answers… on anything really.

Looking on the bright side, the next 6 months could lead to more of the same, with plenty of opportunity for voters to express their views…

And presumably for pundits to get it wrong again…

.png)

[1] Oversampling refers to the practice of having more of one voter type – in this case Democrats – in your poll sample than is present in the population, thus skewing the results. Whether it was done intentionally to help Clinton’s perceived chance of winning, or as a result of mere incompetence is now rather moot.

[2] The American pollsters have now discovered the phenomenon of the “shy Trump supporter”, a synonym of the “shy Tory” familiar in the UK. Of course, it is possible that they were never actually asked their opinion, or that they outright lied to fool them.

Disclaimer

We do not accept any liability for any loss or damage which is incurred from you acting or not acting as a result of reading any of our publications. You acknowledge that you use the information we provide at your own risk.

Our publications do not offer investment advice and nothing in them should be construed as investment advice. Our publications provide information and education for financial advisers who have the relevant expertise to make investment decisions without advice and is not intended for individual investors.

The information we publish has been obtained from or is based on sources that we believe to be accurate and complete. Where the information consists of pricing or performance data, the data contained therein has been obtained from company reports, financial reporting services, periodicals, and other sources believed reliable. Although reasonable care has been taken, we cannot guarantee the accuracy or completeness of any information we publish. Any opinions that we publish may be wrong and may change at any time. You should always carry out your own independent verification of facts and data before making any investment decisions.

The price of shares and investments and the income derived from them can go down as well as up, and investors may not get back the amount they invested.

Past performance is not necessarily a guide to future performance.