Critiques of Passive investing

According to Bank of America Merrill Lynch, passive investing now accounts for 45% of all US assets (up from 25% a decade ago), with equity passive funds amounting to c.$3 trillion at present.

Our attention has recently been drawn to another high-profile investor, Michael Burry (article here), who believes that Passive investing is responsible for creating (another) bubble in asset prices, comparing it to the sub-prime mortgage bubble in that “price-setting in that market was not done by fundamental security-level analysis, but by massive capital flows based on Nobel-approved models of risk that proved to be untrue.” He follows other notable investors, such as DoubleLine Capital CEO Jeffrey Gundlach, who has previously said passive investing is causing widespread problems in global stock markets (though these problems seem to refer as much to his overall performance as to anything else). He called it a “herding behaviour” and said it has reached “mania status.”

With the greatest respect to one of the world’s foremost authorities on mortgage bond pricing and trading, (which are fiendishly complicated at the best of times), I humbly submit that Mr Burry may have made an error in reasoning, known as the “post hoc, ergo proctor hoc” fallacy (which translates as “after this, therefore because of this”). It is a variant on the causation/correlation error, which assumes that two synchronous events (in this instance a perceived bubble in asset prices and the rise of passive investing) has a causative relationship, with passive investing causing the bubble.

But it is far from clear that the relationship runs in this direction; a passive investor buys shares (or any other asset) in proportion to its weight in the Index that the investor is trying to track. As prices rise, the weight of the asset in the Index rises, causing an increased proportional rise in the amount of money that he or she invests in that asset class (and conversely, a fall in the price of an asset causes passive investors to buy less of that asset). Something MUST have caused that price rise first of all and that can only be other investors buying that asset. No Index investor would buy a share (or raise its weight in that share) until it had actually risen, or they would be effectively stock picking (or market timing).

Passive investing is thus essentially reactive to those price gains, in contrast to active investors (of all types), who are proactive, attempting to anticipate price changes in advance of their occurrence [1]. If there are any “distortions” in relative pricing between assets, active managers are free to trade so as to remove them, but the continued existence of these distortions suggests that in aggregate, investors are content with these relative prices.

Burry’s view is that price setting in current markets has not been done by security level analysis, leading to pricing errors similar to those of sub-prime mortgages in 2007. But again passive investing played no part in that debacle and is highly unlikely to do so in the future as it is hard to imagine a passive index fund ever investing in CDOs, or similar asset classes. Given the huge number of CFA’s all of whom are presumably investing to attain above market returns, highly intelligent analysts are already doing this high-level analysis. If prices remain where they are (in relative terms at least) it suggests that there are no significant pricing discrepancies, or that they are not worth removing.

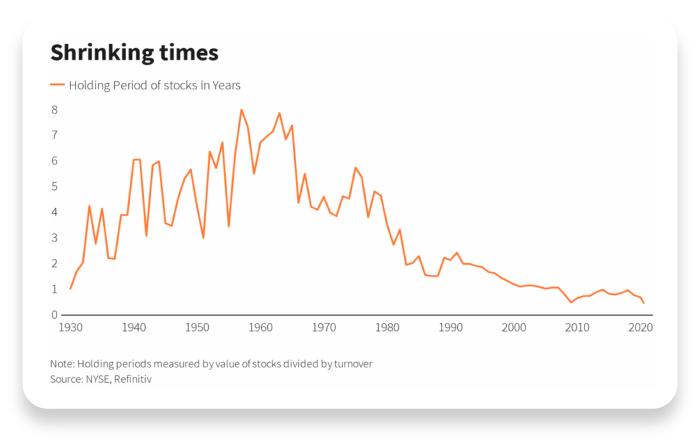

There is a whole litany of other perceived problems with passive investing, regarding market efficiency etc. (see the link at the bottom of this post for a full list), one of which is that investors are becoming much shorter-term in outlook, as the chart below highlights. It clearly demonstrates this phenomenon but predates the rise in passive investing by at least a decade, again suggesting that other factors are at play. Obviously, if passive investing were universally employed, average holding periods would RISE not fall.

There is also an increasing perceived “liquidity risk” as overall market volumes fall, with the implication that a major sell-off would lead to a stampede for the exits, as panicked investors all try to sell at the same time. But passive investing is, by its nature, a buy and hold strategy and so in theory would not react to sharp price moves in either direction. We have seen empirical evidence of that in the last few years, as they have not bailed out of equities at the first sign of trouble (most recently in the COVID 19 decline) and if a deadly global pandemic did not do so, it is hard to see what would prompt such a reaction. It was active managers (and investors) that sold aggressively during the most recent market turmoil, just as it was during the 1987 crash, the Dot-com bubble and the Mortgage bubble. Passive investors in aggregate did more or less what could be expected of them-very little.

A plausible culprit for market structure failings and the consequent rise of passive investing (if one is looking for a miscreant), can be found in the form of Central Banks; their super low interest rate policies and their evident refusal to allow any significant asset price declines has been one of the catalysts for investors shifting from active managers to passive vehicles as it appears that downside market risk has been removed. This has led to a “rising tide lifts all boats” effect, leaving active investing with no “edge” or advantage as alpha disappears almost entirely. Investors are behaving entirely rationally, since if there are no stock-picking benefits to be garnered, why pay the fees associated therewith? Central bank interest rate policies are clearly having the effect of creating “zombie” companies, (that is, enabling the survival of economically inefficient firms that cannot compete without easy access to cheap capital) and thus may be intensifying the deflationary cycle that investors find themselves in at present. But again, why is that the fault of passive investors? It is up to active managers and investors to cull those firms from their portfolios and the resulting price falls will inevitably seal their fate. To expect index investors to do this job would be to expect them to go against their investment mandates.

What of EBI? Naturally, we are invested on a global basis and thus broadly have a market capitalisation weighted exposure to US equites, (though not directly linked to the S&P 500 Index), which currently amounts to c.60% of the global market. Should the US fall out of favour in the world, this exposure would automatically fall. This is a feature of passive investing, not a bug. The problem for non-passive investors is what is the alternative? One can either invest outside of an Index (and risk returns that bear no relationship to those of global equity markets, thus increasing dramatically the chance of a negative outcome), or not invest at all and guarantee a sub-par outcome. To illustrate, a 3% annual inflation rate over 20 years would reduce the real purchasing power of £100 to just £55.37, a reduction in real wealth of nearly 45% [2].

For active managers to berate investors for choosing to invest passively, seems, as this article concludes, to be nakedly self-interested. If they are looking for scapegoats for their current woes, they may be better advised to look elsewhere, starting with the mirror.

[1] One problem with this narrative is that it does not explain significant price moves. Tesla, for example has risen 2.6x since June 2020, which many might ascribe to bubble dynamics, but it is NOT a member of the S&P 500 (which reflects the bulk of passive investment vehicles) and is just 3.5% of the NASDAQ 100). So it is hard to see how that alone can be responsible for the 20% rise in the S&P over that same period or the 27% gain in the latter Index over that time. On 4th September 2020, it was announced that Tesla would not be included in the next S&P 500 re-shuffle, which temporarily at least removes the possibility of imminent Index tracker buying of the stock. Any selling pressure in the next few days will thus be unrelated to Indexing -related fund flows.

[2] 1.03^20 = 1.80611. £100/1.80611 = £55.37.

Disclaimer

We do not accept any liability for any loss or damage which is incurred from you acting or not acting as a result of reading any of our publications. You acknowledge that you use the information we provide at your own risk.

Our publications do not offer investment advice and nothing in them should be construed as investment advice. Our publications provide information and education for financial advisers who have the relevant expertise to make investment decisions without advice and is not intended for individual investors.

The information we publish has been obtained from or is based on sources that we believe to be accurate and complete. Where the information consists of pricing or performance data, the data contained therein has been obtained from company reports, financial reporting services, periodicals, and other sources believed reliable. Although reasonable care has been taken, we cannot guarantee the accuracy or completeness of any information we publish. Any opinions that we publish may be wrong and may change at any time. You should always carry out your own independent verification of facts and data before making any investment decisions.

The price of shares and investments and the income derived from them can go down as well as up, and investors may not get back the amount they invested.

Past performance is not necessarily a guide to future performance.