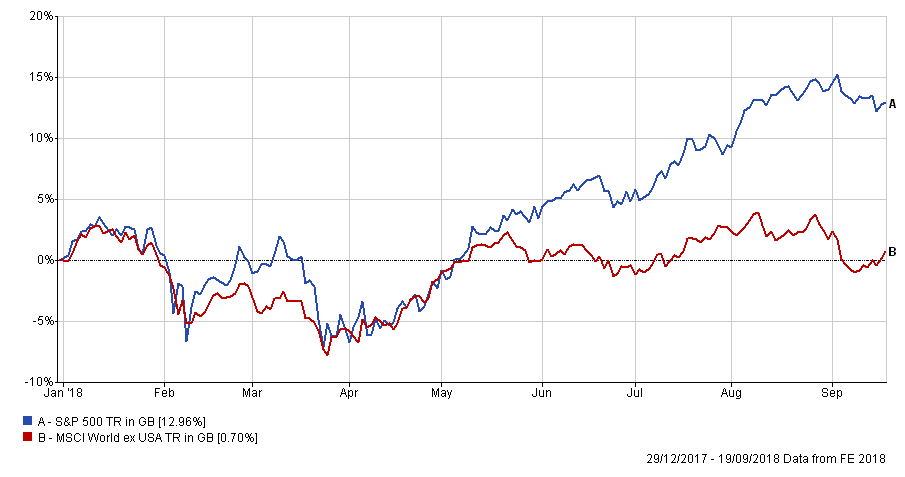

The doctrine of “Amercian Exceptionalism“, which has been around for a while, has mainly applied to politics and international relations, but recently it appears to have moved into the realm of asset markets – in the last year, US equity returns have diverged significantly from those of the rest of the World, with the last 4-5 months seeing the US markets going their own way, with little regard to global trends. The chart below shows that in the last 4 months or so, they have diverged massively from World ex-US equities, as an apparent “rolling bear market” has engulfed Emerging Markets, Europe, the UK and Asia. As of 19th September, the MSCI World Index (including the US) is +4.8% year-to-date; ex the US, it is down 0.9% .

The obvious “culprit” for this is US Corporates themselves. As Credit Suisse’s analyst, Andrew Garthwaite, has observed, since the 2009 low, US firms have bought up around 18% of the market cap of the US, whilst US Institutions have sold 7% of market cap. Add in the continued refusal of individual households to buy shares (possibly as an artifact of the scars of 2007-09) and the result is that pretty much the only buyers of stock have been company’s themselves. Cumulative flows data suggest this has continued up to July. Opinion is of course divided on whether they constitute a good thing (notably, Hedge Fund guru Cliff Asness of AQR is a vociferous proponent), but in a stock -option based world, management clearly benefits hugely from this phenomenon and the correlation between the rise of asset prices and that of economy-wide inequality seems to be very high [1]. This is not to say that firms have not been engaging in Capital Spending – they have; in the first half of 2018, S&P 500 firm Capex rose by 19% to £$341 billion, its just that Buybacks rose much faster, and are now the biggest use of Corporate cash (for the first time ever).

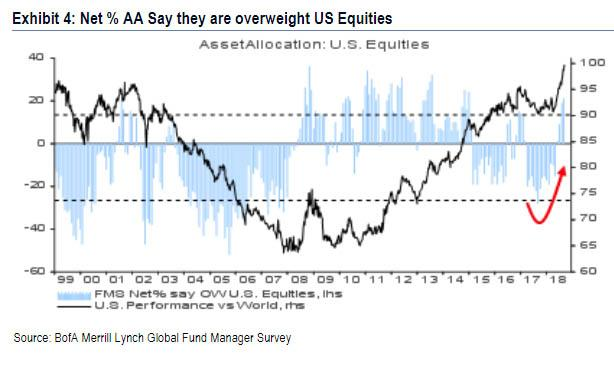

Of course, Occam’s Razor might provide a simpler answer – US investors are (once again) “irrationally exuberant”! Nearly ALL bubbles of the last 30 years have emanated from the US; today, (Friday 21/09) we have another panic-buying stampede into US equities at the open (for the fourth day in a row), whilst bond yields are rocketing [2]. “Investors” are paying 700 points more for the Dow Jones Index than existed on Tuesday morning and 500 points more than pertained on Wednesday lunchtime! The S&P 500 yield is now 1.8%, which is now less than 3-month Treasury Bills (which now yield 2.16%). In order to outperform the 5 year Treasury, the Index MUST rise to 3,390 by September 2023 – this is not a great bet, but one that they appear to be unanimously enthusiastic about. The latest Bank of America Fund Manager survey (who control c.$724 billion in AUM between them), reveals that they have piled into US equities and have gone 10% underweight to Emerging Market equities in September (versus 43% OVERWEIGHT the region in April this year). Meanwhile, there is net 24% expectation of slowing Global Growth next year, which does not square with the huge selloff (and equally large short positions) in US bond markets. A net 69% of those surveyed believe that the US was the most favoured region for Corporate profits looking forward. They see Long FAANG positions and Short EM as the most “crowded” trades (i.e. those vulnerable to reversal), but seem to be investing in them anyway. This, despite the almost complete paucity of evidence to suggest that US de-coupling from the rest of the world can be sustainably maintained. I wonder why Active Managers struggle to outperform Indices.

Of course, investors could be implying that the trade war etc. will be negotiated away in some sort of compromise, but, given the almost obsessive focus of successive US Presidents (and Congressmen and women) on “market reaction” to nearly everything, the buying that they are currently engaged in, will paradoxically, make it less likely to end amicably, as Trump and other politicians see market rises as an endorsement of their policies – if the markets wanted this to end, a 5% + fall would short-circuit the “warfare” almost immediately. So the buying is, in fact, self-defeating – it increases the risk of what investors say they fear most, of actually occurring!

But there is a more interesting (and MUCH less widely discussed) possibility; according to the Macro Tourist website, last Friday (14th September), was the last day that US firms could deduct their Corporate pension scheme contributions at the old US Corporate tax rate of 35% and will henceforward have to do so at the new rate of 21%. This has resulted in them bringing forward their pension contributions to take advantage of that higher deductible rate. This has led to a surge in demand for “duration” as seen in the rise in US Treasury Strip holdings [2]. This is not likely to be the whole explanation for the rise in US equity markets, but pension funds will have bought equities too – some $300 billion in overseas cash holdings was repatriated back to the US in Q1 2018, at least some of which will have been used to buy stocks.

The out-performance of the US also implies that the Fed will remain more likely than not to continue to raise interest rates, which could attract even more capital to the US, further reinforcing the trend – though the Dollar hasn’t seen the benefits in the last few days! IF the world outside the US looks less than pristine, the obvious choice for global investors is to buy the cleanest dirty shirt in the laundry basket, which at present, looks like American assets.

Naturally, this could be the peak – it is impossible to know and the above may only be an interesting theory; our allocation to International Equities is currently at +24.36%, tantalisingly close to our re-balance threshold of +25% (for the UK Bias portfolios), which means that should this out-performance continue just a little bit more, we would be looking to sell International (read: US equities) and buy more bonds. This may seem counter-intuitive, but it is about risk control – EBI 70 (the reference portfolio) is currently effectively EBI 75, as a result of the relative out-performance of equities vis-a-vis bonds, and so is above the target allocation our clients originally set as their risk budget. Re-setting it back closer to EBI 70 (by selling equities and buying bonds) allows them to take profits on (a portion) of the portfolio and get back to their preferred allocation level. It may mark the point of reversion for US assets (or may not), but that is of secondary concern. What matters is that the investor is comfortable with their risk exposures, such that they do not feel the need to panic sell as a result of an unexpected fall in portfolio value, caused by weightings rising too far above their comfort zone. And that allows them to stay the course, though it does mean that, for only the third time in the last 4 years, we might have to do something…

[1] Of course, correlation is NOT causation; but the embryonic advent of socialism in the US, suggests a lot of people “buy ” this connection.

[2] According to economic theory, Interest rates are a key valuation input into equity prices, so rising interest rates should be a negative for equity prices; that they are currently being ignored is either a sign that investors are being delusional – again – or that the theory is bunk.

[3] Treasury Strips are “created” by buying a bond, splitting it into two (the coupon and the bond) and selling the coupon paying part. The result of this is (for pension funds) the ownership of a bond with a deep discount to face value (or par) and a high bond duration, which is what a pension fund requires (to match its pension liabilities).

Disclaimer

We do not accept any liability for any loss or damage which is incurred from you acting or not acting as a result of reading any of our publications. You acknowledge that you use the information we provide at your own risk.

Our publications do not offer investment advice and nothing in them should be construed as investment advice. Our publications provide information and education for financial advisers who have the relevant expertise to make investment decisions without advice and is not intended for individual investors.

The information we publish has been obtained from or is based on sources that we believe to be accurate and complete. Where the information consists of pricing or performance data, the data contained therein has been obtained from company reports, financial reporting services, periodicals, and other sources believed reliable. Although reasonable care has been taken, we cannot guarantee the accuracy or completeness of any information we publish. Any opinions that we publish may be wrong and may change at any time. You should always carry out your own independent verification of facts and data before making any investment decisions.

The price of shares and investments and the income derived from them can go down as well as up, and investors may not get back the amount they invested.

Past performance is not necessarily a guide to future performance.