Overall Market Backdrop, April

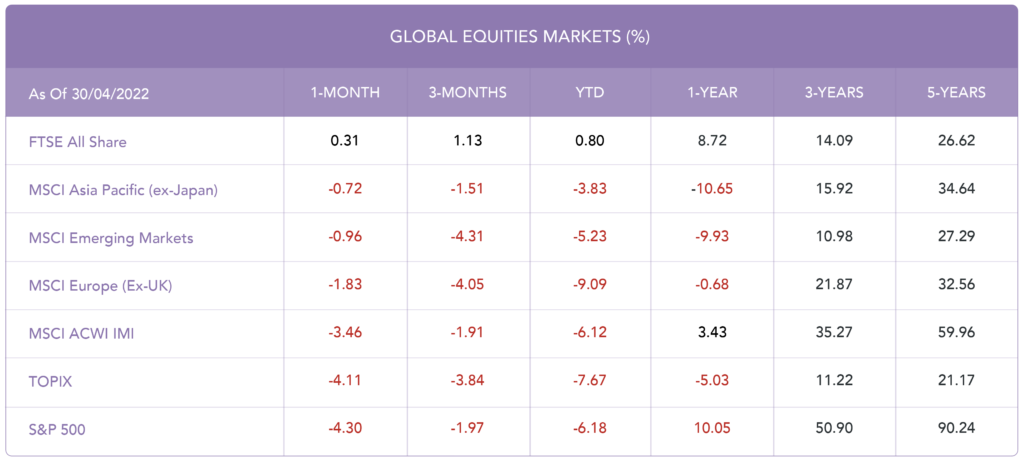

- Almost all equity markets sang to the same tune in April and saw negative returns, the only outlier being the UK market which saw very marginal positive returns.

- Central banks are now seen to be walking on a tightrope, causing concerns for investors as they tend to balance the pressure of inflation with an already slowing growth rate.

- Sovereign bond yields once again saw an increase globally, with the US 10-Year Treasury increasing by over 50 basis points and ending at 2.88%.

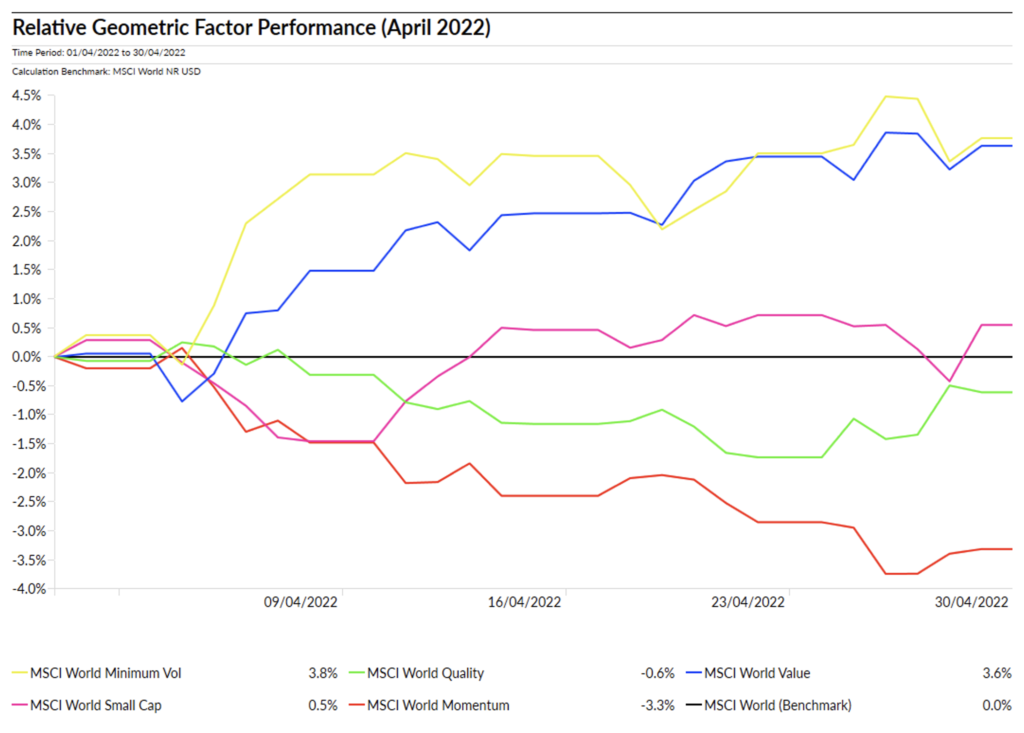

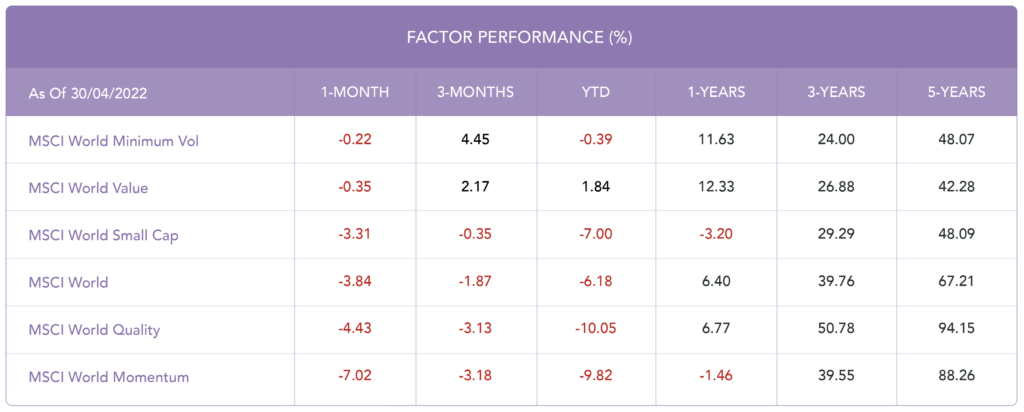

- Minimum Volatility has now been the best performing factor for 2-months.

Drivers of Market Conditions in April

- The combination of the continuing war in Ukraine, lockdowns in China hampering global supply chains again and the prospect of substantially tighter US monetary policy have created an economic backdrop which has not been supportive for equities in April.

- US equities saw a sizeable drawdown in April which resulted in the region being the worst performing for the month. With inflation standing at 8.5%, the highest level since 1981, the hawkish sentiment coming from central banks (in particular the Fed) has hurt growth style equities, with the Technology industry being the hardest hit. There have been continuous hints from US policymakers that the proposed timeline for the balance sheet sell-off will be accelerated. It looks like even with the new batch of earning reports being quite strong, the positive effects have been offset by fears of steeper US rate hikes. The downward pressure on equities was increased by Chinese lockdowns once again damaging supply chains around the world.

- While European equities performed better than US equities, they still saw negative returns for the month. The reoccurring themes among all equity regions are fears surrounding growth rates, high inflation and tighter financial conditions. The ECB unlike their US and UK counterparts have left policies unchanged for now. With no signs of a resolution yet to the Ukrainian war the European economy continues to suffer from the main impact being on energy markets.

- There was some positive news coming from US economic data which may help combat inflation in the short term. Tax day is swiftly approaching and many US citizens are expecting refunds on their 2021 tax filings. The data is indicating this may be much larger than in previous years due to many policy changes, one being the expanded child tax credit. This boost in cash may well provide some relief and a buffer against inflation for the upcoming months.

- With inflation soaring, two of the most impacted sectors have been the energy and housing sectors. House prices are now at record highs and in the US, mortgage rates have increased by more than 1.9% since YTD. March data shows that those existing home sales have decreased by 2.7% month-over-month. The consensus seems to be that future rate hikes will have a lesser impact on home sales due to the supply-demand imbalance.

- International Bond yields continued to rise in March. Yields have surged on the back of a possible increased rate of aggressive monetary policy tightening and hot inflation prints. The likelihood for the monthly balance sheet runoff to begin in May has also pushed yields higher. There was a slight drawback in yields towards the end of the month which was caused by increased concerns over an economic slowdown, persistent inflation and the Covid-19 breakout in China. The shift in the path of monetary policy that we have seen over the last year has indubitably affected bond yields as the market is now pricing in interest rates of over 2% in both the US and the UK by the end of the year.

- The Russian-Ukraine war has caused many structural trends to either change or become supercharged within Europe. We have already seen how the conflict has caused an upward rush for commodities. As a result of European countries rushing to cut their dependency on Russian commodities, it also triggered a serendipitous effect, one that is pushing European economies to become greener and the goal of achieving net-zero has been fast-tracked.

- During the early stages of Covid-19, the Chinese government did a good job at keeping the virus under control albeit using draconian tactics. The picture looks different now as China is struggling to contain a major outbreak. During April, Shanghai has endured some of the severest lockdown rules seen which have damaged market sentiment.

How did Factors Perform in April?

The Minimum Volatility index has continued its reign as the top-performing factor for 2-months now. The combination of continued volatility coming from geopolitical, inflation, and tighter monetary policy concerns has created an economic backdrop that suites the defensive factor. As equities have been declining YTD it’s ideal to see the Minimum Volatility factor successfully safeguarding itself from the full decline.

Blog Post by Raj Chana

Investment Analyst at ebi Portfolios.

What else have we been talking about?

- All that glitters…

- Q1 Market Review 2024

- March Market Review 2024

- February Market Review 2024

- January Market Review 2024