A year in review in any given year, the task of sitting and condensing a year’s worth of undulations in the equity, bond, commodity and currency markets, and parsing through the myriad crosswinds of socio-political and macroeconomic forces that played out during the period, is an arduous task. In 2021, it became truly Herculean.

Topics we cover:

• Equities

• Fixed Income

• Factors

• Inflation

• Economy

Life is what happens when you’re busy making other plans

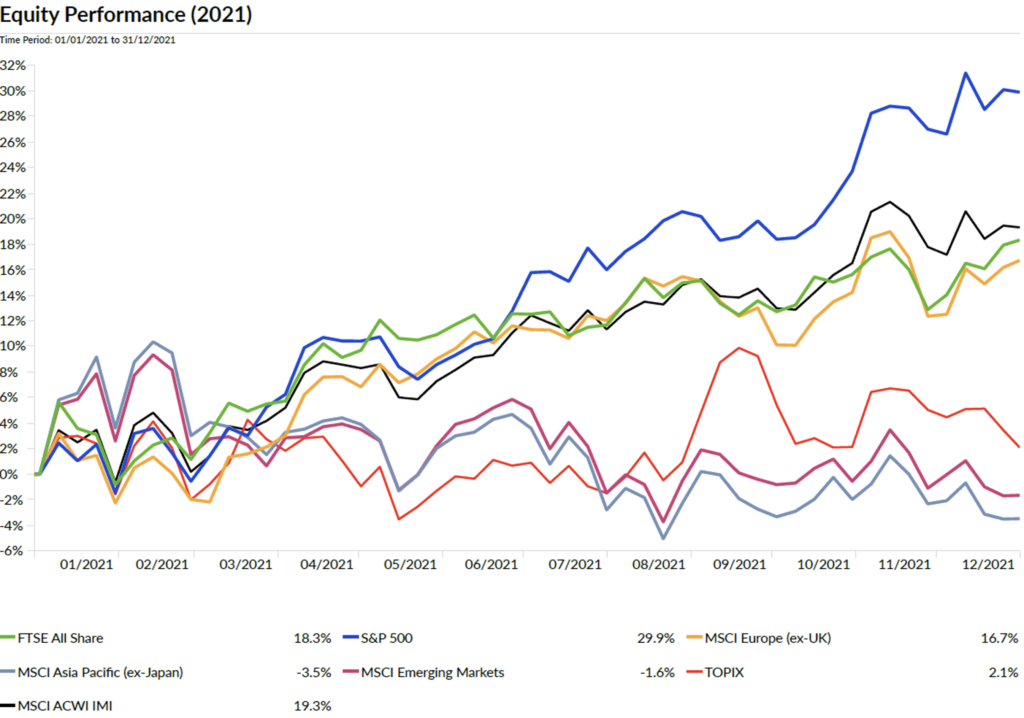

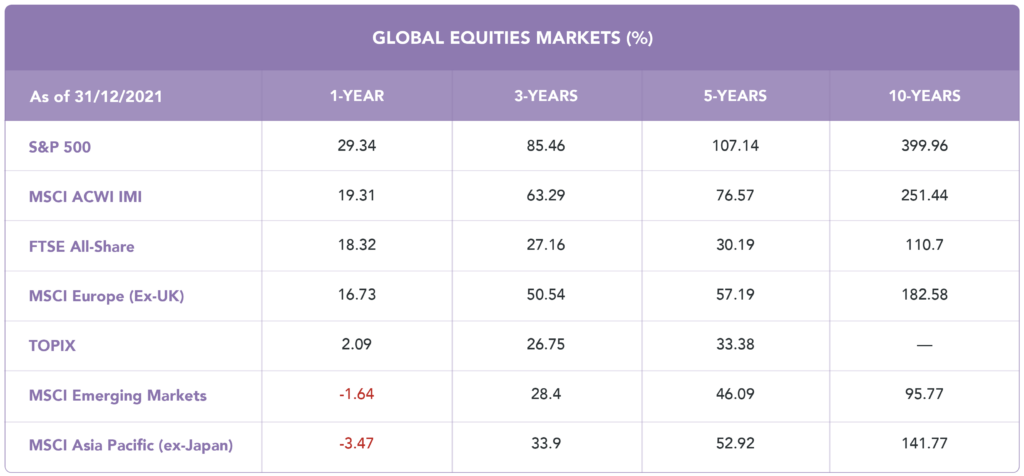

2021 was a year filled with uncertainty and anticipation and yet, developed markets came out with strong performances led by the S&P 500 which gained an impressive 29%. While the whole scenario seems like a juxtaposition, the strong performance by developed markets came from a vaccine-fueled recovery and central banks realising that Covid wasn’t a beast that could be slain solely by huge amounts of stimulus (even though it did help). We also saw a transition of sorts, from a vaccine-fueled and policy-led recovery to a more fundamentally-driven expansion; most of the year we saw uncertainty and fears being fought off by strong economic data pouring in throughout the developed world. Market performance, therefore, remained fairly strong, even amid supply chain disruptions, a contested presidential election, ongoing virus concerns and inflation concerns. 2021 once again shows the difficulty of making investment decisions based on predictions of where markets will go.

Equities

While the numbers for the developed world look impressive, it is essential to unpick the numbers as it was anything but smooth sailing for equities. Even though investors thrived on the back of a turbocharged monetary and fiscal stimulus, this occurred while facing nonstop setbacks throughout the year. The S&P 500 notched 70 all-time highs in 2021, a record that’s second only to 1995. The central banks have supported economies throughout the pandemic and the amount has been unparallel to anything seen before, and the story wouldn’t be complete without the mention of the Federal Reserve (Fed). Throughout 2021, the Fed kept interest rates at all-time lows while continuing to pump billions of dollars into markets, this increased investors sentiment to seek out higher-returning assets, like stocks.

The start of the year saw Democratic wins in the two run-off elections in Georgia in January set the stage for newly elected President Joe Biden to ‘go big or go home’ on the latest round of fiscal stimulus. With this, Biden sent through a $1.9 trillion fiscal stimulus package, which was passed and is now being distributed to the populous.

We also saw a strong correlation with countries that were leaders in navigating the Herculean task of vaccinating an entire population and equity returns. The early leaders were the USA and the UK while Europe was not too far behind but has had a rather more tepid rollout, and Japan was oddly lagging, although infections seem to have slowed there, perhaps because of a pre-existing cultural norm toward wearing masks whenever infected. Vaccine efforts often led to a quicker reopening and restarting of the economy, and with this in mind, there is no surprise that the US, UK and Europe have seen the highest returns. In the second quarter, investor concerns had risen, stemming from the spread of the delta variant and an increase in inflation, however, this seemed to be offset by strong economic data and continued central bank supports; the US equity market gained after a bipartisan agreement on an infrastructure package, albeit a fraction of its original $4 trillion proposals that would be partially funded by higher taxes on corporations and high-income individuals. The package at the time was stated to inject $1.2 trillion into the economy over eight years.

In the third quarter, we saw fears of a slowing global economic growth rate take hold of developed markets, combined with previous fears of high inflation and news that suggested central banks would start tapering sooner rather than later.

While the fourth quarter started with an initial equity sell-off which largely affected US equities, this was followed by a quick rebound driven by strong economic data. US equities benefited from the results of the Q3 earnings as the data showed more than 80% of companies beating earnings expectations. The financial and healthcare sectors did particularly well and started this earnings season strong. Covid-19 continued to provide setbacks for the economy as rising global cases causing confirmed the arrival of a fourth wave late in 2021. The emergence of the highly infectious Omicron variant in South Africa quickly gripped the market and led to a spike in equity market volatility at the end of November which led to a sell-off. Many equity markets pulled back from highs following this and many of the gains made before this were quickly erased following concerns. The arrival of the Omicron variant caused a clear split in policies between the US and Europe. While the UK and European markets came out reasonably unscathed, the same can’t be said about US equities. The UK and European countries have been leaders in implementing effective health policies accompanied by an effective form of vaccine deployment, which has allowed economies to continue despite successive virus waves. Markets also reacted positively following data from South Africa and the UK indicating a lower risk of severe disease from the new variant.

Emerging Markets

While developed markets had a good year, on the other side of the coin was Emerging Markets. While covid has caused major supply chain issues which heavily impacted parts of the emerging markets, this can be seen mainly as a 2020 issue. Early on in the year, we did see big economies like India struggle with handling the pandemic but this issue peaked towards the first half of the year.

Emerging Markets had a rough year resulting in negative returns, the main culprit being Chinese equities which have struggled and dragged emerging market equities down. News that harmed equities seemed to be ongoing throughout the year for China and the speed and intensity of regulation clampdown resulted in downward pressure on equities. Early on in the year, we saw Chinese equity investors fears increase as private tutoring companies turned into non-profit organisations, the main fear being that investors feared this theme may drip across to other sectors. A big theme for China throughout the year stemmed from regulation changes and social reforms, the technology sector faced the brunt of most of these changes so far with bans on children playing computer games for more than three hours per week. There was also downward pressure coming from a potential default of a large Chinese property developer, Evergrande, which rapidly became a household known name, and the potential domino effect occurring from a possible default caused a shock felt around the world. Interestingly, while the developed work is now focussing on increasing rates, The People’s Bank of China (PBOC) has taken a different approach in terms of monetary policy by lowering the lending rates by 25 bps to support agricultural and small enterprises. China also still implements a zero covid policy which may also cause future supply chain issues.

Fixed-income

For fixed incomes, we have generally seen yields increase throughout, for example, the US 10-year treasury started the year at 0.92% and ended at 1.51%.

The US and UK yield curve saw yields generally increase but as a bear flattener, this means that short term interest rates increased more than long term counterparts. This seems to coincide with general policy moves which are pointing towards Quantitative easing being in the past and being replaced with a type of Quantitative tightening. This is a trick that the central banks have in their monetary policy bucket which gives them more short term interest rate control.

Germany has seen things slightly different in the fixed income space as long term yields continues to rise rather than short term yields, resulting in higher spreads.

In general, due to equity markets being on fire it has detracted from bond returns, and policy shifts have resulted in sharp increases to bond yields. The hawkish outlook from central banks was a regular occurrence through many developed economies throughout the year with banks suggesting that it could incorporate interest rate hikes at a quicker pace.

Inflation

Higher inflation and concerns about how that might derail economic growth was some of the talking points in 2021. The reopening of economies, a record amount of savings, pent up demand, a V-shaped recovery and the abundance of liquidity helped push asset markets up and cause inflation. There were also fears associated with; if the central banks turned the liquidity taps off, then risk assets will suffer. Nevertheless, inflation caused investor fears to be persistent throughout the year and has provided increased volatility. In the first half of the year, central banks continued to reiterate that inflation is solely transitory. But as the months passed it became obvious that inflation is becoming more troublesome and central banks are transitioning between thinking it’s just transitory, to an actual issue. There were hints early that suggested they may stop buying additional assets and may switch to quantitative tightening.

While inflation was at the forefront of many investor concerns, inflation was boosted by the energy sector, especially in Europe. As a gauge, the energy sector returned around 39% in 2021 while the S&P 500 returned around 30%. This European surge was driven by an unreliable supply of gas coupled with falling investments in thermal energy and maintenance work on nuclear power plants, which led to a sharp rise in gas and electricity prices across the continent. Many of the central banks have now acknowledged inflation concerns and have stated that there is potential for it to disrupt markets in 2022. This has pushed central banks to adopt a more hawkish stance:

- The Federal Reserve has announced plans to accelerate the tapering of asset purchases from $15 billion to $30 billion per month, beginning in January.

- Even in the midst of the Omicron wave, the Bank of England raised interest rates by 0.15% to 0.25%.

- The European Central Bank (ECB) reconfirmed that the pandemic emergency purchase programme (PEPP) will reduce purchases to approximately €40 billion per month.

Factors

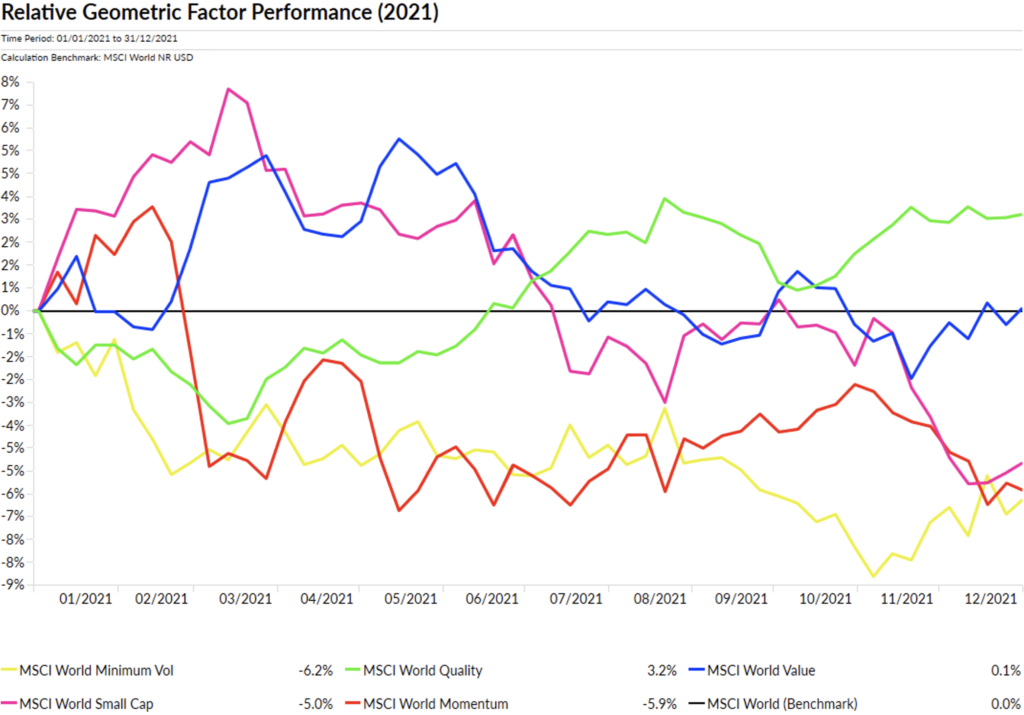

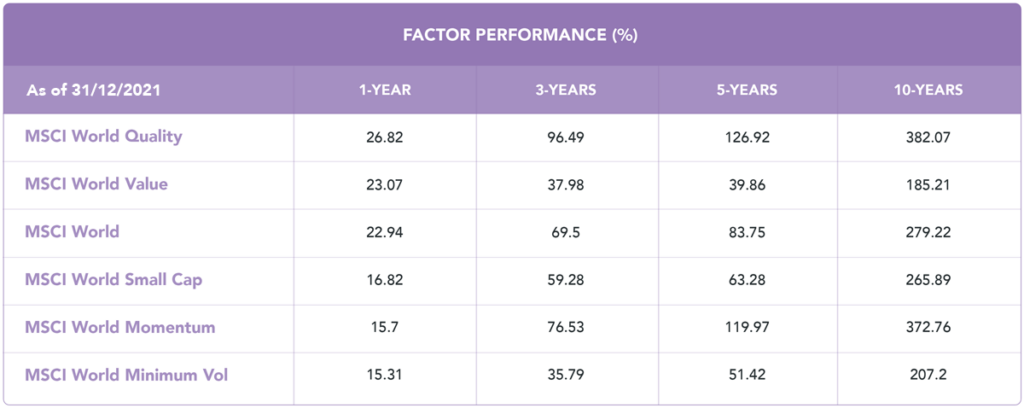

As early as Q1 we saw a pronounced rotation away from growth and into Value stocks. Accordingly, the main beneficiaries of an economic reopening handily outperformed the market during the first quarter, with Value climbing by 8.55%. With the vaccine deployments hogging headlines early on in the year, businesses were well into the first green shoots of recovery, and as investor appetite once again returned, Value benefited. Value is traditionally seen as a cyclical factor and there is no surprise it has ridden the wave of economic recovery. Value stocks also ended the year strongly, this may have been driven by a couple of factors. Value companies are traditionally known for their relatively low valuations but having characteristics of generating high dividend yields, with inflation and interest rates on the rise, Value stocks could benefit because the profit from Value stocks comes much sooner whereas growth stocks have been largely Valued due to their future earnings forecasts. Due to this, an increase in inflation translates to a higher discounting rate which makes future income relatively less today.

While Quality didn’t have the start to the year that Value did, it still steadily gained a head of steam as Q1 wore on (in January it saw a drop of -2.54%, in February we saw a further loss of -0.59%, and then March ended the quarter with a solid gain of 5.19%, bringing it into the black for the quarter to the tune of 1.91%.). However, after the early setbacks, Quality stocks continued making strong gains throughout the year and has proven to be a resilient factor.

Quality companies tend to have structural tailwinds, strong balance sheets, and strong cash flows which makes the factor ideal to be resilient against a range of outcomes in the pandemic and economy, therefore there is no surprise that the Quality factor has been the best performing factor within the last year. The economic reopening has continued throughout developed economic markets but there are still concerns over inflation, global growth rates, and virus cases which has created an environment that is optimal for the Quality factor. Companies that have Quality characteristics have also spearheaded the strong economic data pouring in, and this can be seen when looking at recent economic data, companies that have these qualities have proven to be robust and have subpar earning reports throughout the pandemic. The continued outperformance of Quality stocks also shows an unfamiliar scenario where there is a continued preference for defensive stocks rather than the more typical recovery/cyclical factors we’ve seen after other market downturns in the past.

The rotation toward size and value comes at the expense of Momentum and Minimum Volatility, and further adds credence to our mantra that all of our factor exposures be viewed as parts of a working machine, and not as stand-alone components. Managing the ‘risk’ part of risk-adjusted returns is just as important as how the ‘returns’ portion performs. While many can argue the year has been filled with volatility, the increased volatility never manifested into negative returns, as can be seen in the developed space. The Minimum Volatility factor deliberately seeks to curtail upside moves by enhancing support on the downside due to its added value being seen in its ability to insulate itself from more of the downside losses than it foregoes in upside returns.

What else have we been talking about?

- All that glitters…

- Q1 Market Review 2024

- March Market Review 2024

- February Market Review 2024

- January Market Review 2024